Tesla is losing about $6,500 a minute - or about as much as a Model 3 costs in the time it takes to read this story.

Whether you’re someone who sees the glass as half-full or half-empty, there’s plenty to ponder as Tesla prepares to reveal its first-quarter earnings on Wednesday.

The California battery-carmaker saw a big surge in production of its critical new Model 3 during the January to March period – but still fell 20% short of its target. Nonetheless, that was expected to have pushed revenues up 16.5% during the quarter, to $3.14 billion, according to Zacks Consensus Estimates. But with the automaker struggling to get things running smoothly at its Fremont, California assembly plant, quarterly earnings are expected to plunge 153.4%, year-over-year, with Tesla running a per-share deficit of $3.37.

Short-sellers seem to be the ones with the biggest smiles these days, as Tesla’s worsening cash burn problem leaves investors wary and worried that the carmaker may soon have to beg Wall Street for money to keep its operations going.

And just months after shareholders approved a new pay plan that could ultimately put billions of dollars in CEO Elon Musk’s bank account, the South African-born entrepreneur is starting to take some heat. The Tesla board is being asked to consider a proposal by one shareholder that would strip Musk of his title as chairman in favor of putting an independent director in that post.

“It is more and more difficult to oversee Tesla’s business and senior management that may result from combining the positions of CEO and Chairman,” shareholder Jing Zhao states in his proposal – which Tesla’s board has said it does not support.

(After teardown of Model 3: How can such a good car be so bad? Click Here for more.)

Nonetheless, investors have shown mounting concerns as Tesla’s stock price has plunged by nearly a quarter from its $389.61 52-week high to just $293.51 a share when trading opened on Tuesday morning.

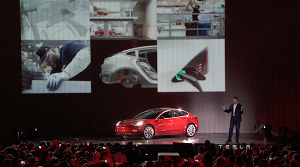

The ongoing lag in Model 3 production has clearly weighed on Tesla. The automaker originally hoped to roll out 100,000 of the mainstream battery sedans last year but managed to build only a few thousand. By the end of March, the line rate reached just over 2,000 a week, but that was still far short of the projected 2,500 electric sedans. Now, Musk is promising Fremont will hit 6,000 by around the end of the second quarter, but analysts caution there’s little corporate history to support it meeting this goal.

Even then, production is so backlogged that there are mounting signs that many of the more than 400,000 folks who plopped down $1,000 for an advance Model 3 reservation may be rethinking their plans. That’s especially true among those who want the basic version of the sedan which Tesla promoted as costing just $35,000. The problem is that it has so far focused on producing only well-equipped models costing about $10,000 more.

(Tesla ready to go round the clock to boost Model 3 production. Click Here for the latest.)

There is logic to that strategy, of course, as Tesla desperately needs all the revenues it can get considering the Bloomberg news service estimates it is burning through cash at a staggering rate of $6,500 a minute.

A chunk of that is going into development of future products, including the downsized Model Y SUV, as well as a new Roadster, an electric pickup and the battery-powered Semi truck. But Tesla is also spending prodigiously on getting the Fremont plant in shape. Musk recently acknowledged he placed a bad bet on automation that has proved counter-productive.

“Yes, excessive automation at Tesla was a mistake. To be precise, my mistake. Humans are underrated.” He said in a tweet last month.

The irony is that even with a factory full of robots, the Fremont plant has had far more humans on the shop floor than most assembly plants producing substantially more vehicles. According to trade publication Automotive News, it had as many as 10,000 factory workers in 2016, when total production was just 100,000 vehicles. As it ramps up to hit that 6,000 vehicle a week target, Musk noted, it will now go on a hiring binge.

By comparison, when the Fremont plant previously was run as a Toyota-General Motors joint venture, it needed just 5,000 workers to produce 350,000 vehicles annually. That’s not entirely an apples-to-apples comparison, as Tesla produces more of its own components than many competitors, but the employment gap has nonetheless surprised many observers.

(Click Here to find out why Tesla has been hit with an NLRB complaint over last year’s mass firings.)

And it is likely to continue burning cash at a high rate even as Model 3 production improves. That’s a big problem for a company that has just $3.5 billion in cash and $9 billion in debts – with some big payments due in 2019. No wonder, then, that there is a growing consensus that Tesla will have to seek new capital despite a recent statement that it will “not require an equity or debt raise this year, apart from standard credit lines.”

There are plenty of other concerns facing Tesla, including an NLRB investigation into a mass firing of workers last year that critics contend was driven by the need to get rid of pro-union employees. The automaker is also the target of a federal safety investigation following a fatal crash involving a Model X SUV operating in Autopilot mode.

Even with all its headaches, however, there are plenty of folks who remain strongly committed to Tesla, including both reservation holders and investors. Despite the recent slump in its stock price, the battery-carmaker’s market capitalization hovers around $50 billion, or little more than $1 billion less than domestic auto giant General Motors – which sold nearly 100 times as many vehicles last year.

From $8 billion in 2017 revenues, the more bullish of analysts predict that could reach $47 billion by the end of the decade. Tesla will still have to fix margins and earnings by then, but if it comes close to that target there likely will be few asking Musk to relinquish either of his posts as long as he chooses to remain in command.