Perhaps the most of American of all companies, Harley-Davidson Inc., is being forced to shift some production of its motorcycles out of the U.S. as President Donald Trump’s trade policies are beginning to hit home.

The Milwaukee-based motorcycle maker said in a regulatory filing that the European Union’s response to Trump’s new tariffs on steel and aluminum from the EU, is adding $2,200 to the cost of each motorcycle it exports from the U.S. to Europe.

The EU raised the tariffs from 6% to 31$ on June 22. The production shift comes as Harley said it would take a $90 million to $100 million hit annually rather than pass the cost on to customers. The company didn’t say where it would shift production to, just that it would be outside of the U.S.

“Increasing international production to alleviate the EU tariff burden is not the company’s preference, but represents the only sustainable option to make its motorcycles accessible to customers in the EU and maintain a viable business in Europe,” the company said in the filing.

(Trump doubles down on 20% tariff threat on EU imported vehicles. Click Here for the story.)

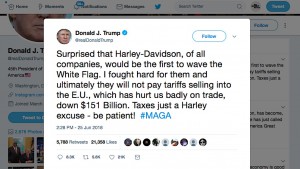

Harley’s already had a tough couple of years as its U.S. motorcycle sales have been falling, forcing it to shutter its plant in Kansas City, Missouri, laying off 260 workers. Now the tariff increase is only making it tougher for the iconic American brand. Trump was not sympathetic in a tweeted response to the move.

“Surprised that Harley-Davidson, of all companies, would be the first to wave the White Flag. I fought hard for them and ultimately they will not pay tariffs selling into the E.U.,” Trump tweeted after the announcement, adding“Taxes just a Harley excuse – be patient!”

However, Harley isn’t the only manufacturer feeling the negative impact of Trump’s tariffs. The recent increases are expected to eat at profit margins of U.S. automakers, or into the checkbooks of U.S. consumers, who would be saddled potential increases if the tariffs remain in place too long.

Worse yet in the eyes of some companies, in response to the new EU increases, Trump threated to put a 20% tariff on all EU vehicles imported in to the U.S., further insisting they build more vehicles in the United States.

(Click Here for more about Trump wanting to drive German imports out of the U.S.)

President Donald Trump, left, reportedly told French President Emmanuel Macron that he wants to rid the U.S. of German cars.

The U.S. imported about 1.16 million vehicles from EU countries last year, according to the U.S. Commerce Department. BMW and Mercedes-Benz produce hundreds of thousands of sport-utility vehicles in the southern U.S.; however, they important all of their well-known sedans such as the BMW 3 Series and 5 Series, and the Mercedes E-Class.

There some domestic automakers who build vehicles in Europe and export them to the U.S., such the Jeep Renegade and Buick Cascada convertible.

Trump’s tariff rhetoric risks hurting consumer confidence and undermining a U.S. auto market that’s expected to shrink for a second straight year, after record sales in 2016, Cody Lusk, president of the American International Automobile Dealers Association, told Bloomberg News.

“You’re already going to see prices going up incrementally as a result of the steel and aluminum tariffs in the auto sector,” said Lusk, whose group represents dealers selling foreign-brand cars in the U.S. “All of that combined with increasing interest rates is a recipe for disaster.”

Trump’s new tariff threat would be negative for “nearly every group in the industry,” according to Moody’s, noting Ford and GM were especially vulnerable. With their wide network of manufacturing outside of the U.S, the company’s could see costs escalate substantially if they are forced to shift production to the U.S.

(To see more about Trump’s auto tariff threat triggering backlash, Click Here.)

“Both GM and Ford would need to absorb the cost of scaling back Mexican and Canadian production and shifting some back to the US,” wrote Moody’s senior vice president Bruce Clark. “They would also likely need to subsidize sales to offset the tariffs during the near term, and could eventually pass on the higher costs to consumers.”

I believe that after closing the Kansas City plant Harley Davidson had plans to open a Tawain plant, long before the trade tarriff smoke screen!