Tesla CEO Elon Musk denied claims in a recent analyst report suggesting that nearly a quarter of all Model 3 orders have been cancelled.

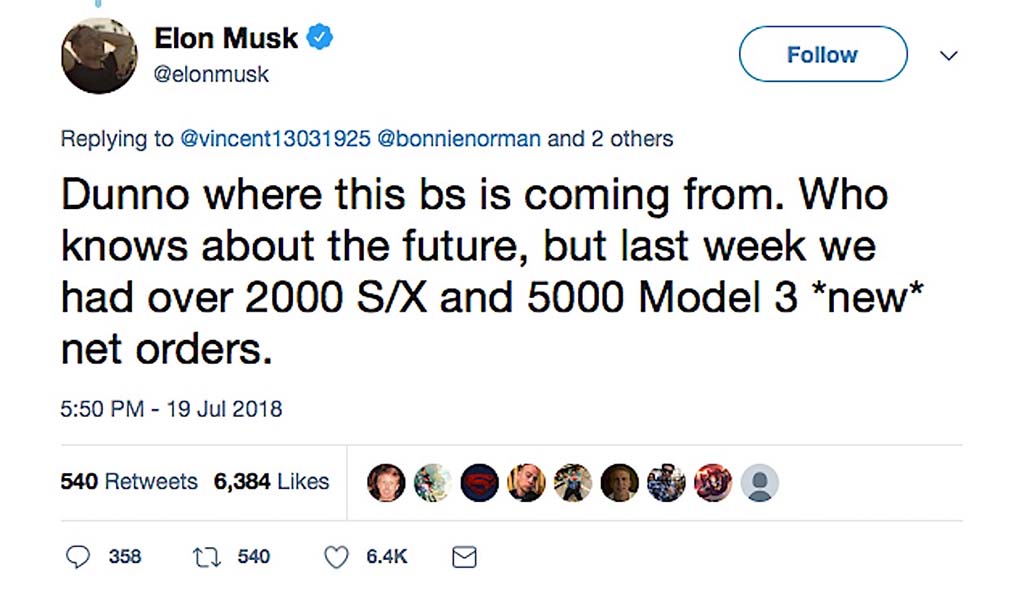

Elon Musk has dismissed as “bs” a report that suggested a growing number of advanced reservations for the Model 3 battery-car are being cancelled.

The recent report from investment bank Needham & Co. isn’t the first to raise that prospect, which could make it difficult for Tesla to achieve its promised profit for the second half of 2018. Needham’s Rajvindra Gill joined a growing chorus of analysts this week in downgrading Tesla shares, triggering another dip in the stock, traded as TSLA.

“Dunno where this bs is coming from,” CEO Musk said in a Thursday night tweet – but by trying to support the idea that there’s still strong demand for the Model 3, the South African-born executive actually may have sent a signal that Tesla is facing longer-term problems. Musk indicated Tesla received 5,000 orders for the Model 3 last week, but that’s actually less than the production target for the battery-car in the months to come.

According to a report Needham issued Thursday, 24% of the estimated 400,000 original Model 3 reservations have been cancelled. That’s slightly higher than the 20% figure reported by data tracking site SecondMeasure in June. Each reservation is accompanied by a $1,000 deposit, so, if Needham is right, Tesla has had to refund more than $100 million and risk the loss of perhaps $4 billion or more in sales.

(Musk apology underscores increasingly erratic behavior. Click Here for the story.)

The latter figure assumes that the typical Tesla will continue to be delivered with added content that pushes it well above the now-dropped $35,000 base price the automaker originally announced. But Tesla could yet recover by finding new buyers to fill the space left by cancellations.

“The notion that Model 3 cancellations are outpacing orders is unequivocally false,” Musk said in an interview with Reuters. Indeed, in his late Thursday tweet, Musk claimed that Tesla took 5,000 orders for the Model 3 just last week, along with 2,000 orders for its older vehicles, the Models S and X.

“The notion that Model 3 cancellations are outpacing orders is unequivocally false,” Musk said in an interview with Reuters. Indeed, in his late Thursday tweet, Musk claimed that Tesla took 5,000 orders for the Model 3 just last week, along with 2,000 orders for its older vehicles, the Models S and X.

But pulling in just 5,000 orders for the Model 3 is arguably not something to brag about. After struggling for a year to resolve what Musk once described as “production hell” at the Tesla assembly plant in Fremont, California, the company claims to have hit a production rate of 5,000 a week at the end of June. And the target is still being ramped up, with the goal of finally reaching the 10,000 weekly figure Musk originally laid out before the Model 3’s launch in July 2017.

Unless orders also increase substantially, that would mean Tesla will start falling behind as it finally takes care of early reservations. How soon it might actually have an order deficit is unclear, and it could take steps to boost demand in the future, such as offering incentives. It has taken that step, at times with the Models S and X.

(Click Here to see why Wall Street is concerned about Tesla.)

On the other hand, automotive planners will note that demand almost always peaks early in a new vehicle’s lifecycle and then dips. And that could be particularly true for Tesla as it will be facing an array of new competitors from established brands like General Motors, Volkswagen, Mercedes-Benz and Volvo over the next two years.

Tesla took 5,000 orders for the Model 3 last week, Musk said, but ultimately its production goal is 10,000 a week.

On the other hand, some potential Model 3 customers may also be holding back since they know there’s currently an order bank that will take well into 2019 to fill. As the time from order to delivery drops they may finally put up their cash.

As for cancellations, Musk himself has acknowledged “some,” though he previously downplayed the numbers as being small. But a growing number of reports indicate order cancellations are accelerating and, on an anecdotal level, some Chevrolet dealers have indicated they are selling Bolt EVs to frustrated customers who cancelled out on Model 3 orders.

The lengthy wait time for delivery appears to be one factor influencing reservation holders and other potential Tesla customers. Another possible factor is the upcoming loss of federal tax credits now that Tesla has confirmed delivering more than 200,000 electric vehicles to U.S. buyers. Those who take delivery before the end of the year will continue to receive the full $7,500 incentives but the figure will be halved during the first half of 2019 and halved again from July to the end of December. Tesla customers will completely lose incentives as of January 2020.

The flap over order cancellations is just the latest issue to nag Tesla. Earlier this week, the carmaker’s stock slid in the wake of a tweet issued by CEO Musk labeling one of the divers who helped rescue a soccer team trapped in a flooded Thai cave a “pedo,” or pedophile. Musk subsequently apologized.

Tesla has to prove it is getting its house in order and could face more intense scrutiny when it reports second-quarter earnings early next month.

(To see more about Tesla hitting the critical weekly 5,000-unit mark for Model 3, Click Here.)

The company is also facing several federal safety investigations into fatal crashes. And a former employee has filed a whistleblower report with the SEC claiming Tesla has inflated its production numbers and hidden safety defects. The carmaker, on the other hand, has filed a federal lawsuit against that one-time battery plant employee, charging him with sabotage.

Lots of stretched assumptions in that article. First off, the 5000 cars was net, not total. Next, Tesla’s sales have never see the typical slumps that other companies have seen. Bolt sales have dropped off the cliff since the Model 3 have been more available so it’s not having any serious effect on sales. As for other car companies coming out with new cars, there are no other cars that are anywhere near ready to be released in the near future. None of the federal investigation have show any fault from Tesla and the so called whistle blower was caught red handed sabotaging equipment.

Jello, LOTS of stretched assumptions in YOUR comment. Let’s work backwards, as I already addressed in other replies the issue of lagging sales.

You imply the “so-called whistle blower (sic) was caught red handed (sic) sabotaging equipment.” Actually, Tesla has claimed the whistleblower installed code that effected manufacturing software and (something you leave out but legit to include) that he provided false information to the media. To date, the question of whether that information is, indeed, false has not been shown, just claimed. And rather than leaving it up to us in the media to debate, I am quite pleased that Mssr. Tripp has taken it to the SEC. They have the resources and motivation to give a complete and unequivocal ruling on whether he is providing false and/or inaccurate data. However the SEC rules you can expect us to cover it completely, including the possibility that Tripp led the media to publish inaccurate or false information about Tesla production, quality, etc.

Meanwhile, the issue of whether he committed sabotage has not been confirmed. And the peculiarity that I and a number of analysts I have spoken to (including several gung-ho Tesla bulls) can’t figure out is why Tesla has filed a civil lawsuit against Tripp but taken no steps to bring him under criminal investigation. That yet may happen but Tesla has not so indicated despite my repeat queries. I know of few companies that have suffered sabotage of the sort described — allegedly interfering with production, hacking and theft of intellectual property with the apparent attempt to distribute to potential competitors — that do not take steps involving criminal prosecution. I decline to take any position on Tripp’s claim that the accusations leveled against him are meant to discredit him as a whistleblower. I would just like a clear explanation, which I have not yet gotten, about Tesla’s unusual approach to alleged sabotage.

As to the order numbers, per my e-mail communications with Tesla they did not dispute that last week’s total fell behind the increasing rate of production. They simply offered an if-come scenario suggesting that demand will rise for a variety of reasons. They may very well be right, and in my responses, above, I included a quote that came in only after we were published. Had I wanted to bias the story I could have raised the concerns that a number of analysts have expressed that Tesla will have trouble continuing to maintain the increased production rate, at least without sacrificing quality. I guess I did hand out a gimme, after all.

Paul A. Eisenstein

In 1 year you will eat crow

Mr. Paul,

I guess you didn’t do a lot of thinking writing this article. I have 2 reservations for Model 3. I have not canceled them, nor I have ordered the expensive versions. That means, if people want to order the expensive versions, they can go ahead of me. Get it. And I think many reservation holders are doing the same as I am. Therefore, your calculation is dead wrong as well as your thinking. Please correct your article if you want to be a fair journalist.

Thank you

TLover, you are asking me to make a broad assumption based on YOUR anecdotal evidence. Intriguingly, and counter to your point, a statement finally sent over by Tesla (which has a history of either failing to respond or responding quite belatedly) suggests that volume will pick up when they add still MORE expensive models, notably “Model 3 Dual Motor All Wheel Drive and Model 3 Dual Motor All Wheel Drive Performance cars (which) will also be available in our stores shortly.” Perhaps so. And perhaps, as the spokesmen also suggested, reservations will be converted into orders when there are vehicles in Tesla’s limited number of showrooms for people to drive. Yep, perhaps. But the longer all this takes the more risk that early reservations will have 1) moved on because they had to wait too long; 2) change their minds because they will lose the incentives; 3) switch to the growing number of alternatives; and 4) well, we could get into the financial problems Tesla will face if they don’t get Model 3 sales building fast. The calculation is far from “dead wrong.” You’re asking me to use anecdotal evidence v hard numbers while Tesla is asking me to go on the if-come based on another list of assumptions. Could the order numbers — and subsequent deliveries — build in the months to come, yep, they could, and I will be just as eager to write about that and how Tesla pulled it off. But, more than 12 months after Tesla’s Model 3 launch there is little to go on that supports ignoring the data I presented. Being a fair journalist is not about giving a company a mulligan or a gimme.

Paul A. Eisenstein