(This story has been updated with a comment by former GM V.Chairman Bob Lutz.)

Since the era when Lee Iacocca was the seemingly ever-present face of Chrysler, perhaps no other automotive executive has been more closely linked with his company than Tesla’s constantly tweeting CEO Elon Musk – and Iacocca didn’t have access to the social media tools that routinely help Musk make headlines.

But the events of recent weeks have started raising questions about the 47-year-old Tesla chief’s role, some observers beginning to wonder whether Musk is starting to become more asset than liability. That has become underscored in recent days as backlash continues to mount over the tweet Musk posted early this month announces his goal of taking Tesla private and suggesting that the necessary funding had been “secured.”

That has triggered a new probe by the Securities and Exchange Commission, it was revealed last week, about the same time Musk sat down by an unexpectedly emotional interview with the New York Times that raised questions about both his health and his ability to remain at Tesla’s helm and, as this week begins, it has led to new warnings about Tesla finances, the automaker’s shares taking a sharp tumble as Monday trading began on Wall Street.

(Musk laments “excruciating” pressures at Tesla. Click Here for more on his revealing interview.)

It didn’t help that J.P. Morgan issued a warning ahead of the morning bell slashing its target price for Tesla stock from $308 to just $195 a share, a number the automaker hasn’t seen in several years.

Musk's extensive use of social media has begun to raise concerns, such as when he had to apologize to a driver involved in the rescue of kids caught in a flooded Thai cave.

“We are reverting to valuing Tesla shares on the basis of fundamentals alone, which entails a $113 reduction in our price target back to the $195 level where it stood prior to our August 8 note,” analyst Ryan Brinkman said in a report issued to investors.

One of the key concerns Brinkman highlighted was the likelihood that Musk had overstated the case to be made for being able to pull together his privatization plan. Pressed to provide more details after releasing his initial tweet, Musk last Monday said he was reacting to a July 31 meeting with representatives of the Saudi sovereign investment fund who had expressed interest on several occasions, Musk claimed, in taking Tesla private.

“Our interpretation of subsequent events leads us to believe that funding was not secured for a going private transaction, nor was there any formal proposal,” Brinkman said in his Monday morning analysis.

Reaction to the privatization plan – which Musk valued at $420 a share, or about $72 billion for Tesla as a whole – has been mixed.

(Musk, Tesla board move forward with privatization plan. Click Here for the story.)

Perhaps the most disconcerting pushback, at least for Tesla and its shareholders, appears to have come from the SEC which, according to several reports last week, has issued summons for Tesla to explain precisely what is going on. Should the government feel Musk materially misrepresented the facts or, worse, intentionally tried to hurt Tesla short-sellers, he and the company could be in for massive fines – or worse.

Not everyone is so concerned. Musk’s August 13th blog post appears to have satisfied Efraim Levy, the automotive analyst with CFRA, who follows up with an advisory to investors to “Hold” Tesla stock. “We think Elon Musk’s blog post likely reduces legal risk fallout for TSLA and helps clarify the potential going private situation, even if a transaction is ultimately not consummated,” Levy wrote.

But it’s not just the question of whether there is funding – or a clear plan – to privatize Tesla that is starting to raise concerns about the company’s co-founder and chief executive. Even within the company, sources are beginning to suggest, there are concerns about whether Musk can maintain control.

According to the Times article, the CEO repeatedly became emotional during his hour-long interview, describing the stresses he has faced over the past year as “excruciating,” and admitting his concerns that “the worst is yet to come.”

He certainly does have reason for concern. Not only is there the ongoing SEC probe but at least three self-styled whistleblowers have now gone public, raising concerns about issues of quality, safety and even about whether Tesla might be illegally wiretapping and hacking current and former employees as well as competitors. There’s also an ongoing case brought by the National Labor Relations Board, investigations by federal safety regulators and lawsuits brought by former employees.

(Musk claims privatization plan based on comments by Saudi investment officials. Click Here for more on that story.)

Then there’s the question of whether Tesla really has gotten its production problems resolved and can both build and sell enough Model 3 battery-sedans to deliver the profits and positive cashflow Musk has promised for the second half of 2018 after reporting record losses during the first half. On the plus side, a new analysis by Evercore ISI suggests the company is finally on target with production.

If Tesla can deliver on the financial numbers it has promised much will be forgiven. But there is still the risk that Musk might snatch defeat from the jaws of victory with another impetuous tweet or blog post, a former high-ranking Tesla executive – who now works for a competitor and asked not to be identified by name – told TheDetroitBureau.com.

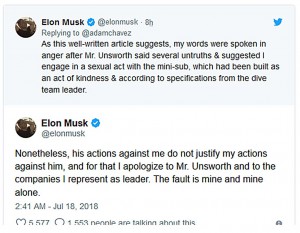

The privatization tweet, along with the Times story, are just two of the recent incidents that have raised questions about Musk’s leadership style – and his long-term benefit to Tesla. The South African-born executive created a severe backlash in May, during Tesla’s first-quarter earnings call, with the way he harshly dismissed questions from several industry analysts. Then, in July, he was forced to apologize to one of the divers involved in the rescue of children trapped in a flooded Thai cave after calling the man a “pedo,” slang for “pedophile.”

That led several traditional supporters to tell Musk to back down. “Your behavior is fueling an unhelpful perception of your leadership — thin-skinned and short-tempered,” Gene Munster, a managing partner at the venture capital firm Loup Ventures wrote in an open letter to Musk.

There have been more concerns raised over the last two weeks. And, notably, after initially telling the Times that he would continue to freely comment on social media, a spokesperson for Tesla contacted the paper to say Musk had subsequently agreed not to discuss the privatization plan before consulting Tesla’s board of directors for guidance.

Indeed, the board has set up a panel of three independent directors who will review whatever plan Musk might present and then the board itself will decide on whether to move forward on privatization.

Few expect to see Elon Musk decide to walk away from Tesla anytime soon. He made it clear in last week’s article he intends to be around for a while as CEO. And his almost cult-like status, according to many observers, has helped build a positive reputation – and buoy sales – for the California carmaker.

But as with Chrysler’s Iacocca and other highly charismatic executives, there comes a time when they need to step aside. That may happen because they reach retirement age, or because they simply get tired of the “excruciating” pressures they face on a daily basis. They may also reach the point where they wear out their welcome because they start to cause their companies more damage than good.

Whether Musk is approaching that latter point is a matter of debate, but his actions of recent months have certainly caused Tesla plenty of headaches.

Huh, I felt and said the same thing about Lutz when he was at GM (and at Chrysler actually). While he wasn’t CEO Lutz performed in pretty much the same manner…