Aston has released a preliminary sketch of its third hypercar, the 003, which it hopes to have in production in 2021.

Aston Martin, the carmaker best known for its relationship with cinema spy 007, has laid out key details of its upcoming IPO while also releasing a preliminary sketch of the hypercar it’s calling 003 that it hopes will drive some of its future success.

Spun off by Ford Motor Co. in 2007, Aston struggled to avoid an eighth bankruptcy during the depths of the Great Recession, but its fortunes have skyrocketed over the last few years, a period coinciding with the arrival of CEO Andy Palmer and the subsequent commitment of hundreds of millions of dollars in new capital from its key investors.

The IPO will go off next month on the London Stock Exchange, Palmer announced, declaring that it “will provide investors with a fitting opportunity to participate in our future success.”

The IPO is expected to set pricing for Aston shares at somewhere between £17.50 to £22.50, or $23.25 to $29.90 at current exchange rates. Only about 25% of the company’s shares will be up for grabs but, if it makes those numbers it would put a valuation of as much as $6.7 billion on the company.

By comparison, Ferrari’s IPO went off at $52 a share in 2015, the stock almost immediately gaining 10% in rapid trading. The stock is currently running around $137 a share, as of late Friday trading, setting a market cap of nearly $26 billion.

“It’s a big stretch for us to see how it can possibly match Ferrari’s profitability,” wrote the auto analyst team at Bernstein, adding a skeptical note that, “We can’t see it getting anywhere close.”

While a bit more upbeat, Evercore ISI analyst Arndt Ellinghorst has advised investors that “revenue growth is going to be critical.”

But Aston thinks it deserves a solid payout which it plans to use to further support its aggressive product development program. In a recent interview with TheDetroitBureau.com, Palmer noted that Aston sold 5,000 cars last year, its best showing since the Great Recession began. That generated £876 million, or $1.1 billion in revenues, a 50% jump, and also put it solidly in the black for the first time in years, with pre-tax profits of £87 million, or $116 million.

(Aston Martin rolls out limited line of “Goldfinger” DB5s. Click Here for the story.)

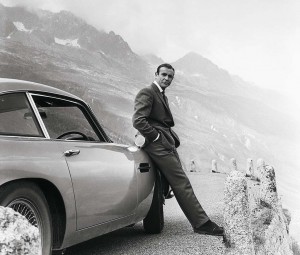

Aston has been best known for sleek sports cars and GTs like the DB5 featured in some of the original James Bond adventures. It last month announced plans to offer a limited run of DB5 reproductions equipped like the car 007 drove in the film, Goldfinger.

But its future is much more closely tied with the array of new offerings that have come to market since Palmer joined Aston – and the products still in the pipeline. In all, the company, which is based in Gaydon, England, will spend more than $845 million on the program which will ultimately see seven core models, as well as a number of specialty vehicles.

The assault began with the launch of the DB5’s successor, the DB11, and, it is now being joined by model number three, the DBS Superleggera, a classic grand touring car. The most critical offering, however, will be the DBX, a prototype of which was introduced at the 2015 Geneva Motor Show just months after Palmer’s hiring. Set to roll into showrooms in about a year, the DBX will be Aston Martin’s first-ever SUV and is expected to be its biggest seller.

Aston actually will beat Ferrari to market in the fast-growing luxury performance SUV niche, the Italian marque just confirming plans for its own utility vehicle earlier this year. But it will go up against a growing number of competitors, including the Urus introduced last winter by Lamborghini.

(Volvo backs out of IPO due to trade, other issues. Click Here for more.)

Relatively mainstream offerings like the DBX and DB11 will be joined by limited-edition models, such as the Goldfinger DB5, as well as halo cars such as the Valkyrie supercar now in final development, with a launch set for 2021.

It will be followed by the newly announced 003. Though the name harkens to the company’s long-running ties to the 007 franchise, it actually translates into the third supercar it has developed in recent year, the 001 eventually becoming the Aston Martin Valkyrie, and the 002, launched in 2017, renamed the Valkyrie AMR Pro.

The Valkyrie was always intended “to be a once-in-a lifetime project, however, it was also vital to us that Valkyrie would create a legacy: a direct descendent that would also set new standards within its own area of the hypercar market, creating a bloodline of highly specialized, limited production machines that can exist in parallel with Aston Martin’s series production models,” said CEO Palmer.

Set to launch in 2021, details about Project 003 are scarce, though Aston confirmed the new hypercar will use a gas-electric hybrid drivetrain which is expected to borrow from technology developed for the Formula One racing series. With the Valkyrie, Aston reached outside for assistance, tapping its F1 team partner, Red Bull Racing. It has not said whether Red Bull will be involved in the development of the new hypercar.

Developing so many new models in short succession isn’t cheap and Aston reportedly spend £224 million, or roughly a quarter of its total revenues, on R&D last year, a significant number even for such a specialty manufacturers.

The partnership with Red Bull has helped keep costs in check, as has a growing tie-up with Germany’s Daimler AG. That company’s Mercedes-Benz unit is providing the infotainment technology used in new Aston models, such as the DB11 and DBS. The British maker is also turning to Daimler’s AMG subsidiary for the V-8s used in new models, focusing on in-house development of V-12 engines.

It also is reaching outside for the development of the fully electric drivetrains that will be used when the long-dormant Lagonda sub-brand is launched early in the coming decade. All of its future products, including another SUV, will be battery-powered.

(Tesla tested as wave of new EVs comes to market. Click Here for more.)

The IPO will be a critical test for Aston and could deliver a big reward for investors, including Daimler which holds a 5% stake in the British marque. The three largest investors include Kuwaiti financial firms Investment Dar and Adeem Investment Co., as well as Italy’s Investindustrial.

After backing the company through years of major losses they are now counting on getting a big boost next month.