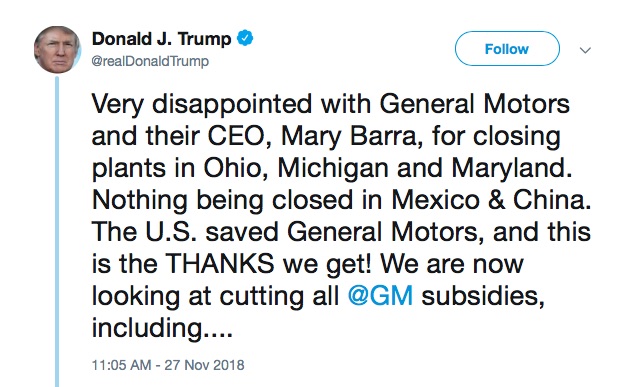

President Donald Trump said he told GM CEO Mary Barra that the country has been "very good" to the automaker.

After gaining ground on the announcement of a sweeping restructuring, the value of GM’s shares dropped by 3% or almost $1 per share, on the heels of an angry tweet from President Donald Trump in which he again attacked GM’s plans to close five plants and eliminate some 14,500 jobs at the company’s operations.

Overall, it was the worst day for GM shares in almost a month.

In a filing with the Securities Exchange Commission, GM also disclosed that GM’s board of directors approved the restructuring plan on Nov. 20, 2018, but held the news through the Thanksgiving Holiday.

GM also said in the SEC filing that pre-tax charges of $3 billion to $3.8 billion related to the restructuring action include $2 billion of employee-related for severance payments and other cash-based expenses.

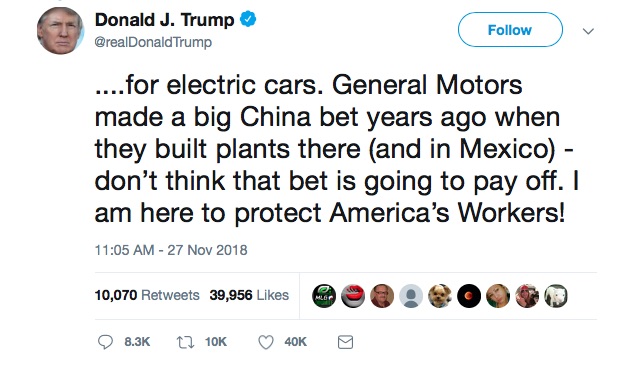

(Trump threatens General Motors with sanctions. Click Here for the story.)

The majority of these charges will be incurred in the fourth quarter of 2018 and first quarter of 2019, with some additional costs incurred through the remainder of 2019. The company expects the vast majority of these cash payments to be paid by the end of 2020, GM said in the filing.

In a statement Tuesday, GM said it is “committed to maintaining a strong manufacturing presence in the U.S.” and noted that “many of the U.S. workers impacted by [plant closures] will have the opportunity to shift to other GM plants.”

The statement also offered an olive branch to Trump.

“We appreciate the actions this administration has taken on behalf of industry to improve the overall competitiveness of U.S. manufacturing,” the company said, without directly addressing Trump’s explicit threat to revoke special tax credits for EVs.

(Click Here for more about GM looking at white collar layoffs due to low buyout response.)

“Cutting all government subsidies would be detrimental to GM, but Trump’s tweets are a bit of an empty threat when it comes to the EV tax credit. GM has already taken advantage of the bulk of the EV tax incentive and will most likely hit the 200,000th vehicle mark at the beginning of 2019,” Jeremy Acevedo, Edmunds manager of industry analysis.

If the President took a more drastic step and eliminated the credit for the entire industry – which would require a massive policy overhaul – this could possibly even give GM an advantage. GM was the first in the market alongside Tesla, and eliminating the EV tax incentive all together would level the playing field as the competition has only started to heat up the segment, he said.

As of the end of October, GM has sold 196,850 qualifying vehicles, according to Edmunds.

Buyers of GM electric vehicles are now eligible for a $7,500 tax credit under federal law. The tax credit is applicable to all EVs, but Trump did not specify how it could be revised to exclude GM. In fact, the company is nearly at its limit for the $7,500 tax credit anyway.

(To see more about Trump chiding GM for plant closures, new Congresswoman blaming Trump, Click Here.)

Once GM – or any automaker – sells more than 200,000 EVs the incentive is cut in half: $3,750. There are a series of sales targets and after each is hit, the credit is reduced. Tesla is the only other carmaker close to exhausting its tax credits for buyers.