Chinese President Xi Jinping is temporarily reducing the tariff on U.S.-built vehicles coming into China.

Following a 2-1/2 hour meeting with China’s Xi Jinping, President Donald Trump said the two had agreed to a truce in the U.S.-Chinese trade war, the Asian leader agreeing to drop tariffs on American-made vehicles.

That would be part of a 90-day cease-fire that could lead to a rollback of broader tariffs that have been implemented in recent months, and a halt to the $200 billion in additional duties Trump had threatened to place on Chinese-made goods at the beginning of the new year.

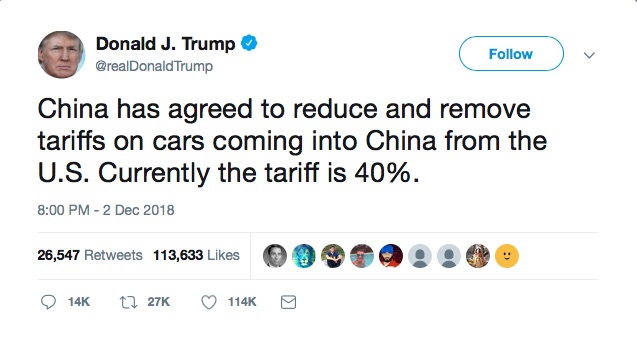

“China has agreed to reduce and remove tariffs on cars coming into China from the U.S. Currently the tariff is 40%,” Trump announced in a Sunday night tweet. But it was unclear if his social media comments were completely accurate given his history of misstatements and the fact that the official White House news feed differed with the president on some key elements of the trade talks with China during the weekend.

Observers are waiting for clarification on what Trump described as “one of the largest (trade) deals ever made,” one that impacts a wide range of goods, including automobiles.

(UAW attacks GM as Trump signs “new” NAFTA deal. Click Here for the story.)

But a report by CNBC questioned some of the president’s claims, noting, “The White House … did not back up Trump’s claims about China ending tariffs, but referred instead to a temporary agreement not to raise them further. And it gave little indication of China ‘opening up.’”

Nonetheless, the possibility that China will pare back the 40% tariffs on American-made cars implemented in response to Trump’s first trade moves is being well-received on both sides of the Pacific.

“If they cancel the extra 25% tariff on U.S.-made cars, then we will see positive signs for imported cars,” Wang Cun, director of the China Automobile Dealers Association’s import committee, said during a news conference in Beijing.

Automakers in the U.S. and Europe had not yet responded to the reported tariff cut, apparently waiting for clarification. But if the president’s tweet proves accurate it could come as a major relief for an industry that puts a premium on free trade.

Currently, there are relatively few vehicles shipped between the two countries, about 250,000 American-made cars, trucks and crossovers going to China, and even fewer Chinese-made products coming here. But there were signs the numbers were set to grow.

(Click Here for more about Volvo’s Charleston plant’s plans for exports.)

Chinese-owned Volvo Cars had planned to export half of the output from its new plant in Charleston, South Caroline, a sizable share of that production earmarked for China. But the extra duties had all but scuttled those plans.

Volvo's new Charleston, South Carolina plant is being forced to ramp down production and limit hiring of new employees.

“We … thought Charleston could build cars for China,” Volvo’s global CEO Håkan Samuelsson told USA Today during an interview at the Los Angeles Auto Show last Wednesday. “That will not work,” Samuelsson added, noting that Volvo would consider shifting some production from Charleston to China, impacting production levels and hiring at the plant.

BMW had also warned it might shift some production from its own South Carolina plant to China. That facility, in Spartanburg, is currently the largest automotive export source in the U.S.

The trade dispute over American-made cars came, ironically, just as China was getting ready to reduce tariffs on foreign-sourced vehicles from 25 to 15%. That cut took effect on vehicles imported from all markets except the U.S., China raising duties on those products to 40%, while duties on Chinese-made vehicles entering the U.S. went from 2.5% to 27.5%.

It remains to be seen not only whether China will, indeed, roll back duties on American-made cars, but also whether such a cutback would be more than temporary – as the two countries begin a 90-day truce while they search for a permanent solution to their trade issues.

(To see more about the EU warning Trump about tariffs, Click Here.)

Meanwhile, automakers are still fretting about Trump’s threat to enact 25% tariffs on vehicles imported from other parts of the world. He repeated his warnings last week but it is unclear whether he will move forward.