Tesla CEO Elon Musk has already signaled that first quarter earnings weren’t going to look good. Just how bad they might be is the big question that has investors and analysts alike in a frenzy.

The automaker won’t report earnings until after the final bell on Wall Street on Wednesday, but based on the poor Q1 sales numbers it revealed a few weeks back, the general consensus isn’t very positive. Analysts polled by FactSet are forecasting a consensus adjusted loss of $0.99 a share.

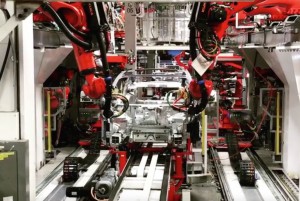

On the plus side, that’s significantly better than the $3.35 a share Tesla lost during the first quarter of 2018. But that was during a period Musk described as “production hell,” when the automaker was struggling to fix issues at both its Reno Gigafactory battery plant and its Fremont, California, assembly line. With those problems largely resolved, Tesla managed to pull a profit for the final half of 2018.

One reason why the numbers for January to March were so weak appears to be the fact that Tesla pulled forward a significant number of sales during the final quarter of last year. Much of that pull-forward appears to have been due to the fact that the automaker was going to see its federal tax credits cut in half on Jan. 1, after its total sales topped 200,000, the threshold set by Congress.

(Tesla CEO Musk set to announce “Full Self-Driving” vehicle today. Click Here for the story.)

That meant buyers could only count on getting $3,750 in federal incentives – a figure that will be cut in half again come July 1, and then eliminated entirely as of Jan. 1, 2020. Tesla tried to offset the impact of the tax credit reduction by trimming its prices $2,000. But sales didn’t come close to matching the sort of trendline CEO Musk has been promising, the South African-born executive indicating the company would be operating at an annualized rate of about 500,000 vehicles by the end of 2019.

If anything, demand has been sliding, and not only for the older Models S and X but for the new Model 3, as well. Tesla has been hoping to offset any U.S. decline by increasing overseas sales. There have been a few bright spots. In Norway, electric vehicles now account for over half the new car market, largely due to Tesla. But, overall, European demand has not grown as expected, nor have sales in China.

The battery-carmaker is hoping to kick start Chinese demand with a new plant under construction near Shanghai, but how soon that will happen remains uncertain.

Complicating matters, Tesla is watching its cash coffers drain, partly the result of aggressive product development programs – with the new Model Y SUV, a high-performance Roadster, a pickup and a Semi truck all under development simultaneously. Meanwhile, it has had to cover borrowing costs, including the $920 million in convertible senior notes that came due during the first quarter.

(Click Here for details about Tesla suing a former employee for theft.)

A number of analysts have grown bearish on Tesla, Evercore switching its guidance from in-line to underperforming on Monday.

“The change in recommendation and lower (target price) are driven by a more cautious view on demand across all Models, but in particular the recent severe decline in demand for Model S/X,” Evercore analyst Arndt Ellinghorst said in a note to clients. “There is increased uncertainty around near-term demand vs previous bullish forecasts and growth cannot stall for a growth company.”

Ellinghorst isn’t the only analyst concerned about what Tesla could reveal.

“Our suspicion is that Q1 EPS could be an outright disaster, given that Tesla guided for a loss with an entire month left in the quarter, and its inherently high degree of operating leverage,” said Garrett Nelson, an analyst with CFRA.

(To see more about Tesla helping FCA head off a massive EU fine, Click Here.)

Of course, Tesla has been known to deliver surprises. But as it gets ready to reveal Q1 earnings, Wall Street and Tesla investors fear that could be even worse news than expected.