Lower-than-expected Model 3 deliveries in the first quarter sent Tesla's stock tumbling 11% in premarket trading.

Many Tesla watchers were expecting a massive drop in first quarter sales compared with last year’s final quarter, but some were buoyed by a prediction that sales would exceed analysts’ estimates. In the end, both sides were left wanting as the company’s sales dropped 31% and the company’s stock is taking the hit, falling 11% in early trading.

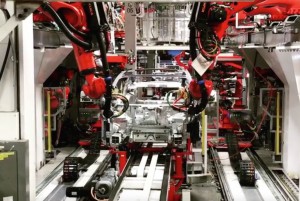

The automaker produced 77,100 vehicles during the first quarter, including 62,950 Model 3 and 14,150 Model S and X. However, it delivered just approximately 63,000 vehicles, which was 110% more than the same quarter last year, but 31% less than last quarter. This included approximately 50,900 Model 3 and 12,100 Model S and X.

The 50,900 Model 3 Tesla deliveries was lower than analysts’ average estimate of 51,750, and perhaps more importantly, was lower than the two previous quarters.

The drop was tied to the company’s deliveries in Europe and China, which took longer than expected for a variety of reasons. In China, for example, deliveries were delayed due to a minor problem with stickers on the vehicles.

(Tesla expected to show big drop in sales – or will it? Click Here for the story.)

The mad rush to blow out Model 3s at the end of the year has left Tesla with very few Model 3s to deliver in Q1.

“We had only delivered half of the entire quarter’s numbers by March 21, 10 days before end of quarter. This caused a large number of vehicle deliveries to shift to the second quarter. At the end of the first quarter, approximately 10,600 vehicles were in transit to customers globally,” the company noted in a release.

The company was quick to note that this issue will be reflected on its bottom line, especially when pricing adjustments to the vehicles to offset the loss of the full $7,500 federal tax credit are thrown into the mix. Officials said despite those issues, “we ended the quarter with sufficient cash on hand.”

In spite of lower-than-expected deliveries, the company did enjoy a few bright spots. In North America, Model 3 was yet again the best-selling midsized premium sedan, selling 60% more units than the runner up. Inventory of Model 3 vehicles in North America remains exceptionally low, reaching about two weeks of supply at the end of Q1, compared to the industry average of 60 days.

(Click Here for details about Tesla suing a former employee for theft.)

Additionally, the company confirmed its prior guidance of 360,000 to 400,000 vehicle deliveries in 2019. This is despite the pull ahead of sales from Q1 2019 into Q4 2018 due to the aforementioned tax credits.

Tesla Model 3 production is expected to still hit levels targeted in Tesla's earlier full-year guidance.

While Tesla put its best face on a disappointing result, analysts still have concerns about what happens next for the EV maker.

Analyst Joseph Spak of RBC Capital Markets said that Model S and X deliveries, which totaled 12,100, were the lowest since the third quarter of 2015, according to Bloomberg News. The drop could potentially translate into Tesla missing revenue estimates by more than $1 billion.

(Tesla reverses position – will keep some stores open. Click Here for the latest.)

“To us, this signals that the tax subsidy cut in the U.S. was a significant hit to these premium vehicles and/or Model 3 is having a bigger cannibalization impact,” Spak said in a note.

Welcome to the real world. Are rebates around the corner?