For only the second time since the end of the Great Recession, U.S. auto sales are expected to decline this year, demand already down around 2% since January. And that’s only one of the many challenges that face an industry struggling with rising costs, tariffs, high interest rates and a variety of other challenges hammering earnings, according to a mid-year update on industry trends by data tracking service Edmunds.

Perhaps the only good news for an industry investing tens of billions in new technologies such as autonomous and electrified vehicles is that demand for battery-electric vehicles is expected to set another record this year. But even there, manufacturers continue to lose money on every BEV they sell.

“Automakers are fighting a war on multiple fronts right now,” said Jeremy Acevedo, Edmunds’ manager of industry analysis.” “Old cars are piling up on dealer lots, a glut of affordable off-lease vehicles are luring shoppers into the used market, and even with the Fed set to lower rates in July, higher interest rates are here to stay.”

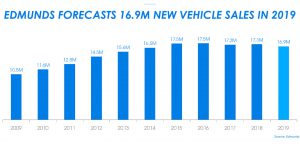

New car sales should come in around 16.9 million this year, down from 2018’s tally of 17.2 million, according to Edmunds. The industry hit an all-time high in 2015 of 17.5 million then dipped to 17.2 million in 2017 before rebounding last year.

(Slumping sales pose serious risk for auto industry. Click Here for the story.)

Whether this will be another temporary aberration or the beginning of another economic down cycle is a matter of debate. A separate study released by the AlixPartners Consultancy on Tuesday forecast volumes will drop as low as 15.1 million by 2021 before beginning to rebound.

There are any number of reasons why sales have been weakening this year, according to Jessica Caldwell, Edmunds’ executive director of industry analysis. That includes the sharp surge in interest rates over the past year. The typical new vehicle loan now runs at 6.2 percent, Caldwell noted, a figure that makes it too expensive for most manufacturers to try to counter the upward trend with zero-interest financing. While there have been signs the Federal Reserve Board may lower rates, Caldwell doesn’t expect to see auto loans drop much further than the “mid-fives.”

Compounding matters, vehicle prices have been on a rapid rise in recent years, the typical 2019 model now carrying an average transaction price – which factors in accessories and incentives – of $37,000. Even by stretching out loans to longer and longer terms, said Caldwell, that is a strain for many potential buyers.

(For more about rising auto loans, record high prices, Click Here.)

Struggling to keep purchases within budget, shoppers are looking for alternatives, not only stretching loans on retail purchases but opting for alternatives, such as leasing. Lease penetration, which fell to a low of 17.0% of the overall new vehicle market in 2009, has come back with a vengeance, topping 30% in 2016. For the first half of this year the figure has hit an all-time record of 32.2 percent, according to Edmunds data.

But even there, costs are on a fast increase, rising from an average $17,125 per vehicle in 2014 to $19,960 for the first half of 2019.

As a result, “The used market has never been a more attractive prospect for many people,” Caldwell said during an interview with TheDetroitBureau.com.

In particular, demand has been surging for factory-supported Certified Pre-Owned, or CPO, programs that offer low-mileage vehicles that have been inspected and, if needed, repaired, while also getting like-new warranties.

In particular, demand has been surging for factory-supported Certified Pre-Owned, or CPO, programs that offer low-mileage vehicles that have been inspected and, if needed, repaired, while also getting like-new warranties.

A reasonably equipped, low-mileage 2016 BMW 3-Series, Caldwell said, may go for $20,000, roughly half the $40,250 base sticker for a 2019 sedan, Caldwell pointed out. Edmunds data shows that the typical, 3-year-old CPO product now carries a price $13,535 less than the same, new vehicle.

These programs could prove especially popular through the coming year, Caldwell noted, because of the flood of off-lease vehicles coming back to the market. But that could further erode demand for new vehicles.

The slowdown in sales has been creating some havoc for manufacturers, with inventories begin to build up across the market. Even SUVs have seen a slowdown in demand in recent months. Caldwell said automakers will try to sell off some of their product backlog with summer sales, but she also noted that, in an unusual situation, dealers are now forced to not only start pitching new 2020 models but also to clear out leftover 2019 and even some 2018 products.

While new car sales did rebound modestly in 2018, the numbers concealed a dirty little industry secret: with rare exception, such as Honda, manufacturers propped up demand by increasing sales to fleets, such as low-profit daily rentals. But, even here, the industry is likely to face some headwinds during the rest of 2019 and into 2020.

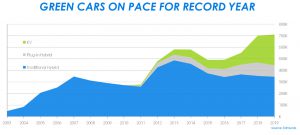

There appears to be one segment of the market gaining traction. Sales of green cars hit a record 700,000 last year and should climb by about 1% for all of this year, according to Edmunds data. Conventional hybrids, such as the Toyota Prius, are actually losing ground, something that appears to reflect the shift from cars to light trucks, as well as continuing, low gas prices. Plug-in hybrid sales are increasing, but the big surge is in the pure battery-electric vehicle segment that could account for around 250,000 sales when the books are closed on 2019.

There appears to be one segment of the market gaining traction. Sales of green cars hit a record 700,000 last year and should climb by about 1% for all of this year, according to Edmunds data. Conventional hybrids, such as the Toyota Prius, are actually losing ground, something that appears to reflect the shift from cars to light trucks, as well as continuing, low gas prices. Plug-in hybrid sales are increasing, but the big surge is in the pure battery-electric vehicle segment that could account for around 250,000 sales when the books are closed on 2019.

Tesla has been the big driver, though a number of other new, long-range entrants are flooding the market, such as the Audi e-tron and Porsche Taycan.

Demand for pure EVs is still limited, said Caldwell, and largely concentrated in a handful of states, with California alone accounting for the vast majority of sales.

Even with green vehicles gaining some traction, they still cost significantly more to produce than conventional vehicles, noted the AlixPartners study, and with the industry expected to spend about $225 billion on battery-car development between 2019 and 2023, it warned, the technology will put a big strain on automakers’ earnings.

Compounded by the slowdown in sales, profits will come under a big strain for at least the next few years, that study warned.