Tesla CEO Elon Musk has been serving as chairman of SolarCity, raising conflict of interest concerns.

Tesla shareholders generally seem to have a lot of faith in founder Elon Musk, who has overcome a number of challenges without raising the ire of outside stockholders, who might be expected to raise a few questions.

But Tesla’s $2.6 billion acquisition of SolarCity – Musk is the chairman of both companies and owns nearly 20% in each – seems to testing the confidence of some shareholders.

At least one shareholder of Tesla Motors Inc. asked a Delaware Chancery Court judge to expedite her derivative suit against the company related to the deal.

In the motion to expedite the derivative suit filed by Ellen Prasinos, she asked the court to move her complaint forward rapidly in anticipation of seeking a preliminary injunction to block the acquisition. Prasinos argues the deal will ultimately harm Tesla’s shareholders, according to a website that tracks court skirmishes. The Delaware judge hasn’t ruled yet.

The analysis is generally shared by a number of outside analysts, who suggest the deal has been fraught with criticism since it was first proposed and some critics calling the move a bailout.

Tesla, under the terms of the deal, SolarCity’s is assuming responsibility for financial woes. It may be inheriting regulatory liability, according to the Huffington Post.

(Tesla to complete takeover of SolarCity despite concerns. For more, Click Here.)

During the last year or so, the Federal Trade Commission has received complaints from consumers about unscrupulous business practices carried out by solar panel companies. It has also been pressured by the United States Congress.

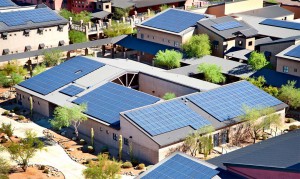

“As a very new industry with a limited track record and little regulatory oversight,” a group of congressmen from Arizona and Texas wrote to the FTC, “the solar leasing market may pose a considerable risk to the increasingly large numbers of American consumers that commit to the leasing product (not to mention the American taxpayer, who heavily subsidizes each rooftop solar project).”

As a result, the FTC recently announced its intention to expand its control over the solar panel industry. Because SolarCity is the nation’s largest provider of solar panels, it is clearly in the FTC’s sights.

There will also be increased scrutiny of SolarCity on the state level.

(Click Here for details about Tesla’s plan to raise more cash.)

“The recent proliferation of new solar projects brings the potential for a new kind of deception,” Attorney General William Sorrell of Vermont has said, echoing a growing sentiment shared by attorneys general across the country, the Huffington Post noted.

However, Musk appears to have insulated the deal from attacks by irate shareholders with a change in SolarCity’s bylaws. He also publicly refrained from voting on the merger, leaving it to others to authorize the deal he outlined.

In addition, Solar City has obtained a fresh infusion of $306 million from a group headed by billionaire George Soros. A private investment fund tied to Quantum Strategic Partners Ltd provided the company the bulk of the investment. Soros Fund Management LLC advised the fund. The deal also includes an 18-year-loan with several other investment groups, the company said Monday in a press release.

(What’s inside the Gigafactory? Click Here for the story.)

Musk facing a potential cash squeeze brought on by the simultaneous need for money for Tesla, SolarCity and Space X, which lost a valuable payload when one of its rockets exploded on the way into orbit last month.