Toyota is counting big sales results from the RAV4 in the United States. The maker has regained the global sales lead it lost to Volkswagen last year.

The battle of the titans has taken a new turn this year. After toppling Toyota as the global king-of-the-hill in 2016, Volkswagen is again finding itself back in second place in the global sales sweepstakes this year.

Toyota saw a real surge in global demand during the first two months of the year. On the other hand, VW lost momentum, especially in the massive Chinese market, where it has long been the leader.

But the real, long-term test could come in the U.S. market where Toyota has been a traditional powerhouse, and VW is still struggling to reverse the significant sales losses it experienced in the wake of the September 2015 revelation that it had rigged more than 500,000 diesel vehicles sold in the States. In contrast to global trends, VW is now regaining American momentum while Toyota is the one struggling.

While both automakers tend to downplay the sales race, it doesn’t take a long conversation with senior company officials to recognize how closely they all follow the numbers. And last year, VW clearly came out on top. It sold a total of 10.31 million vehicles, a 3.8% year-over-year gain, while Toyota delivered 10.18 million vehicles, for a more modest, 0.2% increase.

It marked the first time Toyota lost the global sales crown since 2011, when the Japanese auto industry all but collapsed in the wake of the devastating earthquake and tsunami that slammed the country’s main island.

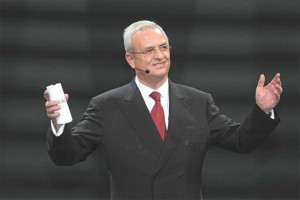

VW’s victory, in fact, came two years ahead of the target date set by former CEO Martin Winterkorn. That was doubly surprising, as Winterkorn was ousted in the wake of the diesel emissions scandal which, in turn, hurt Volkswagen sales, especially in the U.S. But the German maker more than offset that problem with its continued dominance in China.

Former VW CEO Martin Winterkorn set a target of 2018 to take the global sales lead from Toyota, but VW beat it by two years.

(VW bill rises to $25 billion in the U.S. Click Here to see how.)

Not so, as 2017 gets underway. VW sales in China took a whopping 10% tumble in January and February, more than wiping out gains in Europe and the U.S. One of the reasons was a battle between Audi and its Chinese dealers over the possibility of setting up an additional retail channel. Like VW in the mainstream market, Audi has been the market’s luxury leader.

The results aren’t even close, with Toyota gaining 9.4% for the first two months of the year, it reported global sales of 1.71 million vehicles, compared to 1.50 million for VW, which was off 2.6%.

It is, of course, far too early to determine if that trend will continue. Audi could bounce back strongly by resolving its Chinese dealer problems, for one thing.

Meanwhile, both makers will be putting a lot of focus on the American market, traditionally a stronghold for Toyota but a sore spot for Volkswagen.

The German automaker has long struggled to duplicate the success it had in the 1960s and early 1970s, when it was the number one importer and the original Beetle was king. During the past decade, it has ridden a roller-coaster, showing some momentum and then losing it again in the wake of the diesel scandal. VW has also been hurt by an admitted lack of the SUVs that have come to dominate the American market.

(Click Here to see how the diesel scandal has impacted VW profits.)

The maker is getting to roll out a critical fix: the all-new, American-made Atlas. And it has also decided to market not one, but two versions of the smaller Tiguan. Those moves could be critical in recovering from the diesel flap – especially as VW’s oil-burners once accounted for nearly a quarter of its American sales.

Both automakers have to reckon with the fact that the U.S. market is showing signs of losing momentum after one of the longest booms in its history – with three record years in a row of sales. But while overall demand fell 1.5% for January and February, Toyota dipped a whopping 9.1%, including its Lexus brand.

Volkswagen, on the other hand, posted a healthy 14.75% gain for the two-month period. That said, the maker’s total volume for January and February was barely 48,000 vehicles, compared with 317,000 for Toyota, so VW has lots of catching up to do.

It’s not just the battle between Toyota and VW that’s up in the air for 2017. The other question is where the Renault-Nissan Alliance, General Motors and PSA will all land on the sales charts. GM spent 75 years as the king-of-the-hill but slipped behind Toyota as the American maker plunged towards its 2010 bankruptcy. And it has now announced the sale of its European Opel subsidiary to PSA, which will cull a couple million more units off its global total.

PSA could, if it includes the Opel numbers, give chase for the crown. But so could Renault-Nissan, especially after taking control of troubled Mitsubishi and adding that maker’s numbers to its own total.

(Toyota’s earnings tumble. Click Here to learn why.)

So, the 2017 global auto sales race is likely to be a real free-for-all in the months to come.