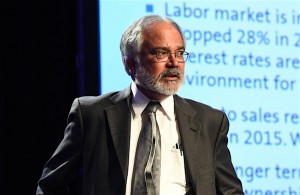

Mustafa Mohatarem, GM's chief economist, predicts the second half of the year will be stronger than the first half has been.

The drop in new vehicle sales accelerated and deepened in July as General Motors and Fiat Chrysler Automobiles N.V. reported double-digit dips in sales and Ford, Nissan, Honda and Volkswagen also reported sales declines for the month.

Only Toyota, Lexus, Audi and Acura registered increases.

GM’s July total sales were 226,107 vehicles, down about 15% from strong levels last year, said GM, which also said the drop represented a strategic retreat by the company.

“We have strategically decided to reduce car production rather than increase incentive spending or dump vehicles into daily rental fleets, like some of our competitors,” said Kurt McNeil, U.S. vice president of Sales Operations.

“We are working hard to protect the residual values of our new products and growing quality retail and commercial sales,” added McNeil, who noted GM’s average transaction prices were about $36,000, up nearly $1,000 from July 2016.

“U.S. auto sales continue to moderate from last year’s record pace, but key U.S. economic fundamentals remain supportive of strong vehicle sales,” said Mustafa Mohatarem, GM chief economist. “Under the current economic conditions, we anticipate the second half of 2017 will be much stronger than the first half.”

FCA U.S. reported 10% decrease compared with sales in July 2016. In July, FCA’s retail sales dropped 6% compared with the same month in 2016 and represented 90% of the maker’s total sales. In line with FCA’s strategy to reduce sales to the daily rental segment. Fleet sales were down, as expected, 35% year over year, FCA reported.

(New vehicle sales expected to fall in July. Click Here to see more.)

The largest planned volume reduction in July fleet sales came from the Jeep brand, which reduced its fleet sales number by 82% year over year. Fleet sales represented 10% of total July sales. Three FCA US vehicles – the Jeep Compass, Chrysler Pacifica minivan and Ram ProMaster City van – each posted their best July sales ever.

Ford Motor Co.’s sales did not drop by double digits but the company still reported a 7.5% decline. Ford blamed the drop on the decision to forego fleet sales but retail sales were down 1% and passenger car sales fell by nearly 20%, Ford reported.

“Customers across the country drove retail gains of Ford brand SUVs in July, ” said Mark LaNeve, Ford vice president for sales, service and marketing. “SUV retail sales were up 9.1% nationally, with growth in every region of the country. High series SUVs were in strong demand with customers representing nearly 30% of retail sales.”

One manufacturer that avoided the drop was Toyota, which saw its sales increase by 3.6%. Lexus also reported a sales increase of 3.6% increase during the month of July.

“In July, Toyota division saw its strongest month of the year so far, and our second consecutive month of year-over-year increases based on sales volume,” said Jack Hollis, group vice president and general manager, Toyota division.

(Click Here for news about Renault-Nissan taking top global sales spot.)

“We are thrilled to see RAV4 sales top 40,000 units in a single month – it is not only a milestone for us, but has set a new best-ever, all-time record monthly total. We continue to see momentum in the industry for light trucks, and are positioned well with strong availability of our SUVs. We are equally excited that the all-new 2018 Camry is receiving a strong reception as it started to hit dealer showrooms last week,” Hollis said.

Meanwhile, Nissan posted a 3% sales drop and after a string of month over month sales increases, Volkswagen of America Inc. reported 5.8% decrease over July 2016. For the year, the company is reporting an increase of 5.9 percent in year-over-year sales.

American Honda Motor Co., Inc. also reported a decrease of 1.2% in July. Combined sales of Honda and Acura cars were up 1.9% trucks decreased 4.2% on sales of 74,512. Acura Division sales were up 3.7%.

The analysts at Kelley Blue Book estimated average transaction price (ATP) for light vehicles in the United States was $34,721 in July 2017. New car prices have increased by $573 or 1.7% from July 2016, while decreasing slightly – 0.3% from last month.

“Once again, the declining sales of cars and the growing popularity of SUVs is driving up the average transaction price,” said Tim Fleming, analyst for Kelley Blue Book.

(To see more about why new car sales in the U.S. may have peaked already, Click Here.)

“Despite modest sales growth for SUVs in a down market, transaction prices in these segments are not particularly strong, with compact SUVs up just 1% and midsize SUVs flat. However, cars could fall to just 35% of overall sales in July, and this shifting sales mix is certainly helping increase most manufacturers’ ATPs.”

Alfa Romeo’s sales also went up about 10%. Just sayin’.