A weak Japanese yen translated into strong earnings for Toyota Motor Corp. during the July-September quarter and has the automaker forecasting improved earnings for the current fiscal year despite sliding sales in North America, its key market.

For the second quarter in Toyota’s fiscal year, earnings rose to 481.21 billion yen, or $4.2 billion, compared with 410.77 billion yen a year earlier. Toyota is now forecasting it will earn 1.95 trillion yen during the fiscal year ending next March 31, or $17 billion at the current exchange rate. It delivered earnings of 1.75 trillion yen, or $15 billion last year.

Separately, Mitsubishi Motors Corp. delivered an unexpectedly solid profit, reversing the losses its suffered in the wake of revelations that it had cheated on vehicle mileage tests. The resulting scandal led to the small Japanese maker’s takeover by Nissan Motor Co. last year.

(“Is that rude?” Trump hammers Japanese automakers. Click Here for the story.)

For the most recent quarter, Toyota reported sales grew 10% to 7.14 trillion yen, or $62.7 billion. That increase came despite weak numbers in the critical North American market. Though the U.S. has rebounded over the last two months, in part due to the need to replace vehicles damaged during a series of hurricanes, sales have been weak most of the year. That has forced significant cost-cutting and the use of hefty incentives. Toyota has also increased its focus on lower-profit fleet sales.

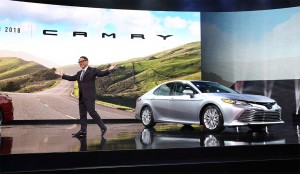

At the same time, it has also had to adapt to dramatic shifts in the market – now being seen in China and other parts of the world – as American motorists have migrated from passenger cars to SUVs and other light trucks. For the first time this year, the RAV4 utility vehicle is expected to become Toyota’s best-selling model in the U.S., supplanting the long-dominant Camry sedan.

For the full year, Toyota now expects to sell about 8.95 million vehicles worldwide. That would be up from its earlier forecast for the year but still down from the 8.97 total it moved during the 2016 fiscal-year. And it likely will position Toyota as third in the global sales sweepstakes behind both Volkswagen AG, which nudged the Japanese aside last year, and the Nissan-Renault-Mitsubishi Alliance which took the lead during the first half of calendar-2017.

(Toyota’s new Supra expected to be sold under new GR performance line badge. Click Here for more.)

Toyota has been scoring some gains with light truck models, such as the RAV4, but it has had to punch up marketing efforts for traditionally strong sellers like the Camry and smaller Corolla. It has also lost momentum with its Prius hybrid family since a fourth-generation model of the original hatchback was launched two years ago.

Japanese automakers, in general, have benefited from a weak yen, however, Toyota now expecting it to stand at 111 to the dollar for the rest of the fiscal year, up from 108 during the previous fiscal year. That helped boost the maker’s quarterly operating profit by 135 billion yen, or $1.2 billion for the quarter. Toyota also boosted the figure by 50 billion yen, or $439 million, through cost reduction efforts. But increasing marketing costs offset those gains by 130 billion yen, or $1.1 billion.

The Japanese auto industry, as a whole, came under fire this week from President Donald Trump during his 12-day tour of Asia. He called on manufacturers to build cars in the United States – the president himself drawing criticism for apparently not recognizing that the Japanese already build three-quarters of the cars they sell in the U.S. in the NAFTA region, the vast majority of those in the U.S. itself.

During the last quarter Toyota also announced that it would add yet another plant in the States as part of a new joint venture with Hiroshima-based Mazda Motors. The bigger maker, meanwhile, announced plans last month to scale back a new plant in Mexico, though officials also stressed that this was a response to changing market conditions and not a move made under political pressure.

Declining sales in the U.S. have been a problem for Japanese makers as a whole, negatively impact earnings as reported earlier this month by both Honda and Subaru.

Mitsubishi, however, was able to offset the slide of the U.S. new car market during its fiscal second quarter with growth in a number of markets, including Southeast Asia and Japan itself. The carmaker had suffered significant losses at home after revealing it had rigged mileage tests on domestic models for as much as a decade. That triggered a financial crisis that ultimately led to a takeover by Nissan last year.

Mitsubishi reported a 23.6 billion yen, or $207.3 million, profit for the latest quarter compared with a 36.2 billion yen loss the year before. It well exceeded the consensus forecast of 20.14 billion yen, according to a poll of analysts by Thomson Reuters.

The automaker now expects operating earnings to surge 1,400% for the full fiscal year, to 70.0 billion yen. And, in its first three-year plan since the Nissan takeover, it predicted global sales will rise 30% during that period.

(Why does Toyota want to take the air out of your tires? Click Here to find out.)