New advanced driver assistance systems like blind spot monitoring and lane departure warning have been shown to reduce accidents and prevent injuries and fatalities. So, why are motorists getting hammered by rate hikes, rather than getting discounts when they buy cars equipped with the new technologies?

The problem, according to industry experts, is that once a vehicle actually is involved in a crash replacing something as seemingly basic as a mirror can be far more costly than motorists might expect because of the sensors all those new safety systems require.

And forget trying to make repairs yourself. Where do-it-yourselfers might once have replaced a broken sideview mirror or even a bumper on their own, the sensors now integrated into those parts need to be carefully calibrated to ensure they work properly.

A study released by the Insurance Institute for Highway Safety last August looked at several of the latest high-tech safety technologies, often known by the acronym, ADAS, or advanced driver assistance systems. It found evidence that lane departure warning was reducing the likelihood of injury crashes by as much as 21 percent. A European study put the number at a substantially higher 53 percent.

Either way, “Given the large number of fatal crashes that involve unintentional lane departures, technology aimed at preventing them has the potential to save a lot of lives, Jessica Cicchino, the IIHS vice president of research, told TheDetroitBureau.com.

(More automakers adding life-saving collision warning technology. Click Here for the story.)

Given the significant benefits already being reported – with more vehicles now being sold with even more advanced technologies, the pay-off would seem to be obvious. “To the extent that vehicles get into fewer crashes that will ultimately be reflected in the rate you pay,” said Russ Rader, a spokesman for the IIHS.

But that isn’t happening. At least not yet. If anything, there’s evidence that motorists may be saddled with higher insurance rates as lane departure warning and other ADAS technologies become ever more commonplace. But why?

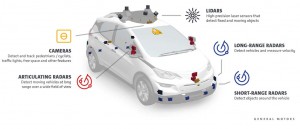

Experts say that’s because these systems make use of an array of onboard camera, radar and other sensors that are, in many cases, mounted in the grille, sideview mirrors or a vehicle’s bumpers and fenders. These are all the sort of places that can get dinged in even minor crashes.

“If they’re damaged, they’re much more expensive to repair,” James Lynch, the chief actuary for the Insurance Information Institute, told USA Today. “You can’t just go to a shop and pick up a part that you can jerry-rig on.

A separate report from Liberty Mutual Insurance found that a bumper for an entry-level luxury car without any sensors will cost about $1,845 to replace, while a bumper with sensors integrated into it costs $3,550 – a 130% increase in parts costs and an 18% bump in labor.

Insurance companies are passing those higher repair costs on to consumers. According to the Insurance Information Institute, the average American motorist paid $915 in premiums in 2015, a figure that jumped to $1,060 last year. The typical motorist will spend $1,150 this year, according to forecasts.

That could be a big surprise to motorists who are routinely ordering vehicles with more optional safety gear – even as manufacturers make these technologies more commonplace. The federal government will begin requiring backup cameras on almost all vehicles produced after May of this year, and a consortium of 20 automakers last year agreed to make forward collision warning technology standard on almost all of these vehicles they produce by early in the coming decade.

But insurance companies will likely pay close attention to what this all means in terms of the money they pay out for repairs.

They may also come under pressure, however, to adjust their numbers to reflect the offsetting fact that there are fewer collisions resulting in injuries and death. And while a replacement bumper might cost an extra couple thousand dollars, even minor injuries can result in tens of thousands of dollars in costs.

Indeed, the ultimate goal of the auto industry is to make vehicles so smart they will be able to avoid most, perhaps even all, crashes. Mark Rosekind, the former administrator of the National Highway Safety Administration, has predicted we are approaching an era where “zero highway fatalities” is a real possibility.

Warren Buffett, the billionaire investor whose holdings include insurance company GEICO, has warned that autonomous and fully driverless vehicles could effectively destroy auto insurers by making their services far less necessary.

(GM wants fed OK to launch robo-cabs. Click Here for the latest.)

Perhaps, but for now, auto insurance remains a necessity. And while motorists may take comfort in knowing their advanced driver assistance systems are helping prevent crashes, they’ll apparently have to accept the fact that this technology will also cost them more money to buy and still more to insure.

(Yet another round of Takata recalls impacts 14 automakers. Click Here for the story.)

2 days in the ICU will pay for just about any total loss or repair.

If the technology saves injuries, and cars (auto braking so a wreck is avoided), I would think the insurance company would pay out less money in claims.