Harley-Davidson is hoping that its first-ever electric motorcycle, the LiveWire, can help with a sales rebound.

Times have been tough for Harley-Davidson. After years of often aggressive growth, demand for its classic American motorcycles has taken a sharp tumble and the Milwaukee-based manufacturer says it will have shutter an assembly plant in Kansas City, Missouri.

At the same time, Harley is taking its lead from the four-wheeled side of the transportation industry and now plans to enter the era of electrification with a battery-based bike it plans to “bring to market in 18 months.”

Demand for electric motorcycles has been slowly gaining traction during the last few years, with even some police departments, such as the LAPD, placing orders for battery bikes.

How that might impact long-term demand is far from clear, but for the moment, Harley’s numbers aren’t looking good. Global demand dropped 6.7% last year and the Wisconsin manufacturer expects another 4.9% decline in 2018. Net income, meanwhile, plunged 82% during the fourth quarter to just $8.3 million.

The biggest hit has come from the U.S. market where aging Baby Boomers had been driving a Harley resurgence during the last two decades. Stateside demand was off 8.5% last year, while international sales fell a slightly more modest 3.9%.

Unlike the automotive business – which enjoyed seven consecutive years of growth until demand finally leveled off in 2017 – U.S. demand for motorcycles took a massive hit during the Great Recession and barely recovered even as the economy started to mend. From peak sales of around 900,000 vehicles in 2006, demand slid to barely 350,000 in 2010, the same year auto sales cratered. But in 2016 – the last year for which total industry numbers are available, sales of on- and off-road bikes came to just 371,403.

Exactly why is a matter of debate, but many Boomers are now at the stage when they’re hanging up their leathers for good, and they aren’t being replaced in the saddle by millennials and Gen-Xers, according to industry analysts.

(Audi scrubs plans to sell Ducati. Click Here for the story.)

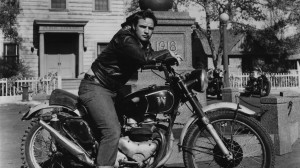

That has been especially challenging for Harley which has traditionally appealed to the sensibilities of older riders who might have identified with the sort of outlaw image of Marlon Brando in his classic film, “The Wild One.”

Signs of trouble became apparent even before the economy tanked. But from 2006 to 2010 the number of Harleys registered in the U.S. plunged by half.

The cache that Harley held with younger riders when Marlon Brando rode one in "The Wild One" no longer applies.

With little near-term prospects for a reversal, Harley is closing the Kansas City plant and consolidating operations into its York, Pennsylvania factory, at a loss of 800 jobs. The process will begin in mid-2018 and be completed by the third quarter of next year, the company said. Ironically, Harley had been held up by President Donald Trump as “a great example” of how American companies were creating more manufacturing jobs.

“Harley can’t get younger people into the hobby, and the bikes are too big to be transportation in Europe or Asia,” Bloomberg Intelligence analyst Kevin Tynan said in a note to clients. Analysts have also noted that lopsided exchange rates have made it more attractive for foreign manufacturers, from Honda to Ducati, to push products to the States.

The legendary brand isn’t set to ride off into the sunset, however. It is trying to find ways to appeal to next-generation riders and wannabes. It started the process in 2013 by rolling out the then-new Street 500 bike. At just 500cc it was by far the smallest model in the company’s line-up and, at around $7,000, its most affordable.

(Click Here for details about BMW’s Vision Next motorcycle.)

The question is how to build demand even more and keep Harley’s three remaining U.S. assembly plants – and facilities in Australia, Brazil, India and Thailand – running, as well.

The Street not only got new riders into showrooms but saw a surge in the number of trainees using it in Harley riding schools. As part of a 10-year plan, Harley is betting even more heavily on those riding academies. And it is planning to roll out an array of new bikes geared more towards millennials.

But will they embrace an electric bike? If reaction to the Harley LiveWire concept is any indication, that could help charge things up.

“The universal appeal of that product was the most astounding aspect of that initiative,” Harley President and CEO Matt Levatich said of LiveWire during an earnings conference call. “It gave us a lot of confidence that electric motorcycles have broad-based appeal. … They are going to sit alongside existing Harleys in garages as much as they’re going to create new interest in the sport.”

Based on the LiveWire, the production bike won’t be geared for those who like long cruises on classic Harley’s such as the Electra Glide. The real electric bike is expected to yield somewhere in the range of 50 miles per charge, barely enough for the typical American worker’s daily commute. And while it will be reasonably quick, at around 4 seconds 0 to 60, it won’t keep up with the likes of a Ducati or even the Zero SR, which can manage that launch in 3.3 seconds.

(To see more about the Nuro’s possible move into the driverless realm, Click Here.)

From scooters to full motorcycles, the market is seeing a burst of electrification, though most of what’s coming to market is being driven by start-ups like Zero Motorcycles. Nonetheless, Harley says it wants to be a world leader in the emerging electric bike realm. How well it succeeds with the production version of the LiveWire should become apparent before the end of the decade.

I personally don’t expect to see many Livewires sitting next to Electroglides in the Harley faithful’s garages. The faithful don’t even recognise the Sportster’s as real man motorcycles. They are “the wife’s bike” or a girls bike.

Maybe they need to get into ATV, UTV and snowmobile markets. Growth in these markets has been phenomenal. Still the same basic components.,just a different end use.

The old saying still goes, if Harley Davidson built an airplane would you fly in it?At least you can coast to the shoulder and call a wrecker when the old hog stalls and dies!

Therr850,

Agreed. The Sportster is a beginner’s bike for male and female, and for a male he’d better step up to a “real” bike in short order. The problem is Harley hasn’t had a good bike since the V-Rod. The Fat Boy is, well, fat and ugly. Plus Harley started turning into a “lifestyle” brand more than anything.

They need something svelte, timeless in style, and durable. I feel the exchange rate really didn’t have anything to do with them losing share, it is their bland & stale styling and overweight, cumbersome bulk. Younger-gens want something agile, sporty, chic, hence Ducati, BMW, or even old British bikes.