In a rare show of pique aimed at President Donald Trump, automakers, suppliers and industry trade groups have all but unanimously voiced their disappointment over new steel and aluminum import tariffs.

The one notable exception has been Tesla CEO and founder Elon Musk who, despite claiming to be generally opposed to import tariffs, appears to be backing the White House. If anything, the tweet-happy executive is spurring Trump to take even broader action, specifically targeting China over the way it handles foreign-made cars, as well as foreign automakers who want to set up manufacturing operations in that country.

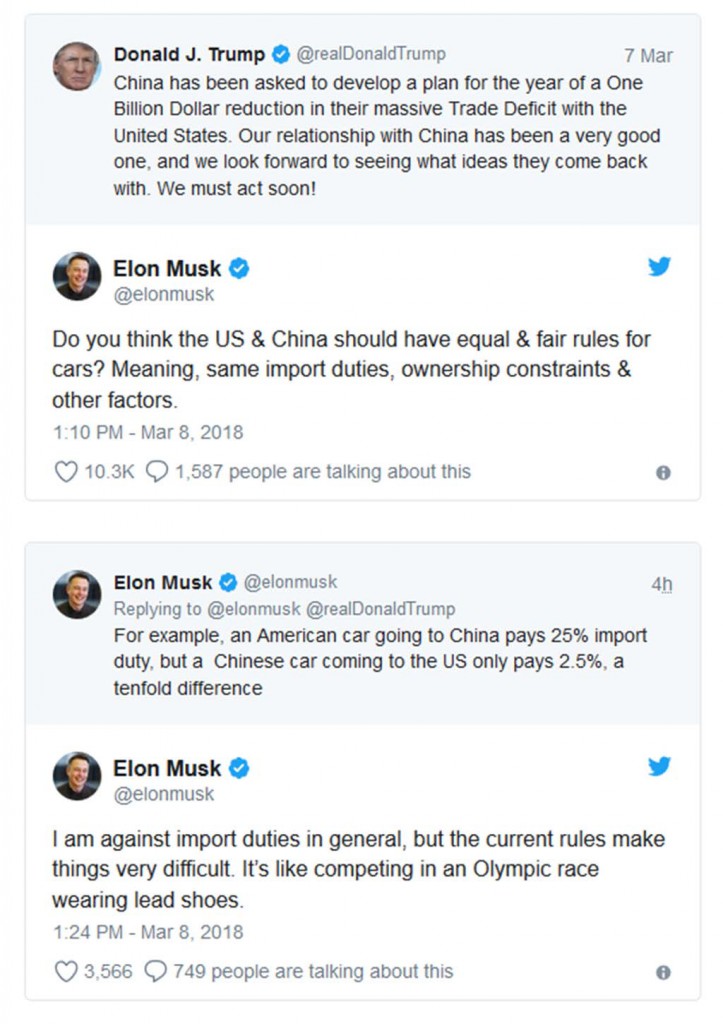

“I am against import duties in general, but the current rules make things very difficult,” Musk said in a tweet. “It’s like competing in an Olympic race wearing lead shoes.”

On Thursday, the president confirmed his earlier comments and announced that, with only a few exceptions, the U.S. would now enact a 25% tariff on imported steel and a 10% tariff on aluminum. The move, which had been widely expected, set off a blizzard of criticism from across the auto industry.

“Dealers remain concerned that any new tariffs could trigger a tit-for-tat trade war, crippling an already flat auto sales market,” warned Cody Lusk, the president of the American International Automobile Dealers Association which, he pointed out, represents brands employing 577,000 U.S. workers.

“Dealers remain concerned that any new tariffs could trigger a tit-for-tat trade war, crippling an already flat auto sales market,” warned Cody Lusk, the president of the American International Automobile Dealers Association which, he pointed out, represents brands employing 577,000 U.S. workers.

(For more on the auto industry response to the new tariffs, Click Here.)

The U.S. auto market suffered its first downturn in 2017 after emerging from the devastating recession that drove Chrysler and General Motors into bankruptcy. Most analysts have forecast 2018 will bring a further, albeit modest, decline, but critics of the new tariffs fear that rising vehicle prices could result in a more severe dip in demand and a concurrent loss of jobs, ironically, affecting workers in many of the states that helped propel candidate Donald Trump into the White House.

Musk largely sidestepped the issue of the steel and aluminum tariff in a Thursday night tweet-storm, primarily focusing on the issue of China, where Tesla has so far failed to come up with a manufacturing strategy acceptable to the Chinese government. Part of the problem is that the booming Asian nation has a firm rule in place requiring foreign manufacturers to partner up with a domestic automaker.

“Do you think the US & China should have equal & fair rules for cars? Meaning, same import duties, ownership constraints & other factors,” asked Musk in one post. The South African-born executive was a member of the economic advisory council set up by Trump at the start of his administration, but he resigned in June, along with other executives, in response to the president’s immigration policies.

“No US auto company is allowed to own even 50 per cent of their own factory in China, but there are five 100 per cent China-owned EV auto companies in the US,” Musk wrote.

(Click Here to see more about the halted NAFTA talks and Trump’s proposed tariffs on steel, aluminum.)

Faraday Future is one of the Chinese-backed carmakers hoping to set up U.S. plants to challenge Tesla.

Whether Musk’s comments are specifically related to Tesla’s problems setting up a plant in China is unclear. But the California-based EV manufacturer does have reason to be worried about what’s to come. Chinese entrepreneurs have set up several American-based battery-car start-ups. Meanwhile, several Chinese automakers, including Szechuan-based GAC, are laying out plans to finally enter the American market. Volvo – now Chinese-owned – and General Motors already import vehicles from China and Ford will soon start shipping to the U.S. Chinese-made Focus sedans.

A handful of Western-made vehicles are shipped to China but, on the whole, tariffs price them out of the market, a major reason brands as diverse as Nissan and Cadillac have raced to set up Chinese factories.

“An American car going to China pays 25 per cent import duty, but a Chinese car coming to the US only pays 2.5 per cent, a tenfold difference,” Musk tweeted, subsequently pointing to India, as well, for auto import duties of as much as 75 percent. Ford is bringing over to the U.S. the first Indian-made model, the EcoSport SUV.

“We are going to be doing a reciprocal tax program at some point, so that if China is going to charge us 25% or if India is going to charge us 75% and we charge them nothing ,” Trump subsequently tweeted back, albeit incorrectly, as there are modest U.S. duties on automotive imports. “We’re going to be at those same numbers. It’s called reciprocal, a mirror tax.”

Trump, during his campaign, warned of his willingness to impose a heavy new tariff on automotive imports, though he largely focused on Mexican-made goods and, to a lesser degree, Japanese autos. He has so far held off on acting but has recently warned of a crackdown should the U.S. fail to get the changes he wants in a revised version of the North American Free Trade Agreement.

(Trump allies are ripping his tariff plan, Click Here.)

Musk and Trump have it right.