Toyota CEO Akio Toyoda is not only pushing for automotive sales growth, but leading the company into the emerging mobility sector.

Toyota saw earnings jump 21% between January and March, the final quarter of its fiscal year, despite having to sharply ramp up incentives in a slowing U.S. automotive market.

The automaker reported a profit of 480.8 billion yen, or $4.4 billion, up from 398 billion yen the year before. Toyota’s sales also rose 2% to 7.58 trillion yen, or $69 billion. For the full fiscal year, it earned 2.49 trillion yen, or $23 billion, a 36% increase, with sales rising 6%, to 29.38 trillion yen, or $268 billion.

The strong performance helped highlight the cost-cutting efforts initiated by CEO and President Akio Toyoda, the grandson of Toyota’s founder declaring, “We’ve become a leaner, trimmer company … and in the past year we’ve developed our remaining fat into muscle, so that we’re in a strong position to be more competitive.”

(U.S. auto sales slide, even as incentives grow in April. Click Here for the story.)

But the company also noted that it will be ramping up R&D spending going forward, as it targets new technologies and services threatening to disrupt the traditional automotive industry. These include such things as vehicle electrification and autonomous driving, as well as the push to create new mobility services like ride-sharing.

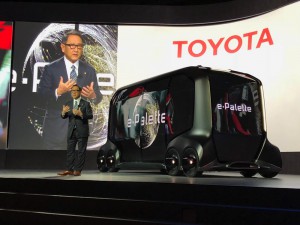

Toyota pulled together a variety of these different efforts into a single concept vehicle, dubbed e-Palette, during the Consumer Electronics Show last January. The battery-powered, toaster-shaped mini-jitney would operate without a driver and could alternately serve as a ride-sharing or delivery vehicle.

(Click Here to check out the Toyota e-Palette Concept.)

The 62-year-old Toyoda has been actively trying to transform Japan’s largest automaker since being named president in 2009. He has pursued a somewhat controversial effort to put more “passion” into the design and performance of products sold by both the Toyota and Lexus brands, while reversing the company’s traditional go-it-alone strategy. It not only has acquired brands like Daihatsu but also engaged in joint ventures with erstwhile competitors such as BMW and Mazda. It has announced plans to partner with the smaller Japanese company on a U.S. plant building a new line of electric vehicles.

He has also pulled together a new senior management team to oversee the many diverse efforts that Toyoda has dubbed, “the seven samurai,” a reference to one of the masterworks of legendary Japanese filmmaker Akira Kurosawa. The goal, Toyoda stressed, is to craft “a future that we forge ourselves.”

That said, the cost of exploring new ventures, including mobility services, won’t be cheap, and Toyota cautioned Wednesday that its efforts – along with a strengthening yen – likely will eat into its operating profits, even as sales continue to grow.

(Click Here for TDB’s first drive in the 2019 Toyota Corolla.)

The automaker is targeting total vehicle sales for its various brands of 10.5 million during the current fiscal year ending March 31, 2019. That would be a modest rise from the 10.44 million sold last year and could once again position it as the world’s best-selling automaker. Depending upon how one counts, Toyota was either second or third in the 2018 calendar-year, with the Renault-Nissan-Mitsubishi Alliance laying claim to being number one, followed by Volkswagen AG.

Even with that sales growth, Toyota cautioned that operating profits are expected to slip to 2.3 trillion yen for the current fiscal year.

It isn’t alone, however. Japanese automakers, with rare exception, are pessimistic about the current fiscal year, with rivals like Honda and Mazda also predicting modest declines. The likely strengthening of the yen is one key factor. There is also the ongoing weakening of the U.S. market that is continuing to force manufacturers to boost incentives. On the positive side, the American market’s shift from sedans to SUVs has boosted transaction prices significantly. And the RAV4, which last year displaced the Camry as Toyota’s best-selling model, routinely delivers higher profits, as well.