President Donald Trump is once again threatening to slap steep tariffs on imported cars, trucks and auto parts, his latest in a series of moves challenging free trade that also sees a continuing effort to rewrite the North American Free Trade Agreement.

Trump said he asked Commerce Secretary Wilbur Ross to investigate whether auto imports are a threat to national security. If so, he would be able to sidestep Congress and institute tariffs under Section 232 of the Trade Expansion Act of 1962 — one of the strongest trade tools in the president’s arsenal. But the proposal is already triggering a backlash from trade partners in Europe and other parts of the world.

“Core industries such as automobiles and automotive parts are critical to our strength as a nation,” Trump said in a short statement released by the White House Press Office.

Currently, the U.S. has one of the world’s lowest tariffs on automotive imports. They stand at 2.5% compared to the current 25% in China. There is one exception, a 25% “chicken tax” on foreign-made pickups that is a holdover from a decades-old dispute with Europe over American-raised poultry.

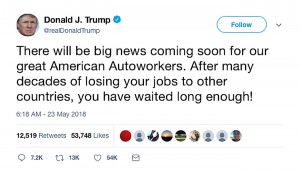

(Trump promises good news for auto workers. Click Here for the story.)

President Trump asked Commerce Secretary Wilbur Ross to see if automotive imports could be declared a threat to national security.

Trump has threatened automotive imports since launching his campaign for the White House, initially targeting Ford for bringing in Mexican-made vehicles, and later adding a list of manufacturers including General Motors and Toyota. While the president backed down from what he initially described as a “substantial border tax” under a fierce counterattack from car dealers and auto industry executives — most of whom are devout Republicans – he pressed forward with demands for major updates to NAFTA.

And now, Trump, facing a series of political challenges, including the ongoing Russian collusion investigation, has returned to the threat of import tariffs. They are part of a broader push on trade that has seen the president announce a sweeping series of moves that initially sent the stock market into a tailspin. Trump backed off on some moves, including hefty tariffs on imported steel and aluminum by giving Mexico and Canada a reprieve and negotiating the framework of separate trade agreement with the Peoples Republic of China.

John Bozzella, CEO of Global Automakers, which represents foreign automakers doing business in the U.S. and some domestic parts suppliers, criticized the move.

“If these reports are true, it’s a bad day for American consumers,” he said. “The U.S. auto industry is thriving and growing. Thirteen, soon to be 14 companies, produced nearly 12 million cars and trucks in America last year,” he said, referencing the soon-to-open Volvo plant in South Carolina.

The Big Three has encouraged Trump leave NAFTA largely unchanged, but that seems unlikely to happen.

“To our knowledge, no one is asking for this protection,” Bozzella added. “This path leads inevitably to fewer choices and higher prices for cars and trucks in America.”

Criticism of the tariff proposal was sharp and came from an array of sources, especially America’s trade partners.

“To cite aspects of national security as justification is totally constructed and far-fetched. We almost have to take this as a provocation,” said Eric Schweitzer, president of DIHK, the German Chambers of Industry and Commerce.

In Asia, reaction was swift and intense as well, a spokesman for China’s Commerce Ministry warning any new tariffs could “undermine the multilateral trade system and disrupt the order of international trade,” while Hiroshige Seko, Japan’s minister of Economy, Trade and Industry warned Trump risks “put(ting) the global market into turmoil.

(Click Here to see how NAFTA talks are encroaching on a Congressional deadline.)

There was some support, however, especially from Detroit where the two biggest domestic automakers saw their shares quickly lifted by the possibility of restrictions on automotive imports.

During a “Talks at GS” conversation with Goldman Sachs Chairman and CEO Lloyd Blankfein, GM CEO Mary Barra said the automaker needs a level playing field on trade with other countries. That would mean either no auto tariffs or equivalent duties.

“If you give us a level playing field, we want to compete and we want to win based on merit,” Barra said Wednesday. “There’s opportunity there to create a level playing field, which we don’t have today.”

Asked about Chinese tariffs that totaled 25% on vehicles shipped from the U.S., Barra added, “I’d like to see it be level. The same going back and forth, or just open up the markets and let us compete,” Barra added.

Ironically, Chinese officials this week announced plans to cut that country’s tariffs on auto imports to 15% from the current 25%, while reducing duties on auto parts to 6%, starting in July.

While GM CEO Barra appeared to offer cautious support for increasing U.S. auto tariffs, the issue of vehicle pricing came up in her conversation at the Goldman Sachs event. American auto sales tumbled slightly in 2017 and are on track to drop again this year, many observers cautioning that rising prices are contributing to the industry’s first slowdown since the Great Recession.

Even proponents caution that new tariffs could raise prices on domestically assembled vehicles, as well as foreign-made cars, trucks and crossovers – due to higher tariffs on imported parts. And that could push more buyers out of the new vehicle market.

(To see more about China cutting tariffs on imported vehicles, Click Here.)

“The thing in the auto industry that you always have to look at is if someone can’t afford a new car, they’ll buy a used car. And if they buy a 5-year-old or a 10-year-old” vehicle, she said.

(Paul A. Eisenstein contributed to this report.)

Barra and Trump got it right. US should match the tariffs and ‘rules’ of other countries. If China has 25% import tariff, US imposes 25% on import from China. If Japan requires a 3 day ‘safety inspection’ on imports, US imposes a 3 day ‘safety inspection’ on imports from Japan.

While I agree with matching the tariffs to level the playing field in principle, the Chinese are already lowering their tariffs, so perhaps caution is best here. You could really wreck the market. Both car and stock exchange…