In a development that leaves the future North American Free Trade Agreement hanging by a slender thread, Andreas Manuel López Obrador was elected president of Mexico in a landslide victory that could lead to sweeping change in Mexican politics.

The leftist Obrador is considered by some commentators as Mexico’s version of Cuba’s Fidel Castro or Venezuela’s Hugo Chavez.

Obrador, who narrowly lost the Mexican Presidency in 2006 and 2012, has forcefully rejected the Castro-Chavez comparison. Instead he ran on a platform that promised to curb corruption in Mexico. But Obrador, who won 53% of the vote July 1, has promised to attack the inequality in Mexico and has said the NAFTA isn’t working for the average Mexican worker needs a hefty pay increase.

Obrador, however, also earned a reputation for being an adept administrator and for being a fiscal moderate as well while serving as mayor of Mexico City. But he’s also attacked his conservative rivals during his successful campaign as being too weak to stand up to Trump.

(UAW blasts GM’s plan to build Chevy Blazer in Mexico. Click Here for the story.)

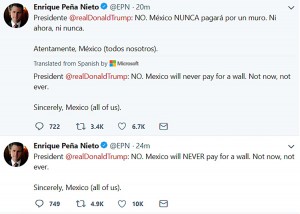

Former Mexican President Nieto tweeted a succinct message to Trump. Then sentiment is unlikely to change under Obrador.

For the past 25 years. Mexican leaders have held down wages with a variety of tactics, including manipulation of monetary policy that kept the peso undervalued and corrupt unions that maintained sweetheart contracts with a range of employers. The goal of Mexican policy makers for the past quarter century has been to make Mexico an attractive alternative to Asia for a broad array of manufacturers including carmakers.

Obrador also was critical of the Trump administration but said in the after winning election that he looked forward to maintaining respectful relations with the United States and the Trump administration, which has been eager to see NAFTA rewritten or scuttled.

While Obrador hasn’t tipped his hand on the NAFTA negotiations, scuttling the existing trade pact could be much more likely outcome when the negotiations resume.

For global auto industry, which has sunk billions of dollars into the infrastructure required to build all kinds of vehicles in Mexico since NAFTA was signed in 1994, Obrador’s sweeping election victory – he won better than 53% of the votes – inject even more uncertainty into a business reeling from talks of steep new tariffs and bruising battle over fuel-economy rules with the state of California. Mexico is also likely to tighten its environmental regulations during Obrador’s six-tenure.

(Click Here to see why NAFTA talks are halted — for now.)

General Motors recently disclosed it was moving forward to build the 2019 Chevrolet Blazer in Ramos Arizpe, Mexico, but Ford Motor Co. cancelled construction of an assembly plant in northern Mexico the one part of the country where support for Obrador was relatively weak.

Suppliers are also facing great uncertainty.

HBPO, a supplier of front-end modules, has planned for further growth in North America with the construction of new plants in Aguascalientes and Saltillo, Mexico, noted Dianne Mannino, president of HBPO operations in North America. HBPO already operating plants in Puebla, Toluca and San José Chiapa, Mexico.

Mannino acknowledged with two plants ready to come on line this year the company is concerned about the ongoing discussions around NAFTA. However, at this point, the company will have to adjust as the negotiations unfold and she isn’t about to make any predictions about the outcome or their potential impact on the company’s operations.

(To see why automakers believe Trump’s investigation of auto parts as a safety risk is ill-conceived, Click Here.)

“We’ll just have to wait and see,” she said.

Get that wall built!

You are a funny one, Dick!