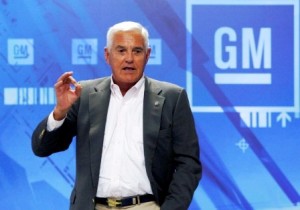

Bob Lutz, General Motors Company’s vice chairman of marketing and communications, vows that the days of GM’s “formulaic and cautious” communications techniques are over.

Speaking briefly at a pizza luncheon for media in Detroit, the silver-haired executive said that the company needed to “shock Americans into a new awareness about the reality of GM products.”

Lutz is predicting a much more aggressive approach to communications and above industry-average spending for advertising in the days ahead.

This could be good news for people shopping for a new vehicle if the information is actually relevant to their needs. Too often auto ads just provide endless lists of features.

This promised shift has been a long time coming, if you follow marketing experts such as Marty Bernstein in TheDetroitBureau.com. Comparative advertising will “shock Americans into the realities about GM products.”

Lutz says the new approach is “basically telling it like it is.”

It didn’t happen in the past because of “old worries that this might somehow or somewhere offend somebody, or that twelve months from now the situation will have changed and somebody would then say let me remind you of what you said twelve months ago – we would rather deal with that, than have the reputation of never saying anything to anyone for fear that at some point we might be caught out,” Lutz said.

That is the reasoning behind the controversial 60-day Money Back Guarantee on GM vehicles and the five-year, 100,000 mile warranty, which is currently being pitched by Ed Whitacre, GM’s less than charismatic new chairman.

“We need to close the perceptual gap,” said Lutz.

Lutz said depending on which outside survey used, consideration for GM’s brands is up about 15% since the new campaign started, and in the case of GMC, it is up “much more” than that.

After 150,000 money-back retail sales, the number of people returning vehicles is only in the “hundreds.”

The GM in-house worries about people using a Corvette for the summer and then returning them proved false, Lutz said. However, one man did return his new Corvette when after two weeks he realized that shifting the transmission was burdensome in traffic. He returned for an automatic transmission model.

GM needs to turn things around, if taxpayers are going to see any return on the billions invested to reorganize the once dominant auto company. The conclusion of “Cash for Clunkers” August, weak consumer confidence, extremely low inventory levels and GM’s battered image — all hurt in September as GM’s U.S. dealers delivered just 156,673 vehicles. When compared with admittedly strong sales a year ago, September’s sales were down 45%. Last year, two promotions — an employee discount sale, and the 100th anniversary sale — resulted in GM’s highest market share since 2005.

If you just look at market share in September, GM was clearly number one with 20.5% — that is more than four share points better than Toyota, and about six share points better than Ford Motor Company. It’s four core brands, Chevrolet, Buick, GMC and Cadillac accounted for 90% of those sales.

Lutz was not making any predictions about October sales results, but he did say he was encouraged so far, the usual retort of perennially optimistic executives. Industry observers will clearly be looking at Chevrolet to see if it can pick up the sales lost by now defunct Pontiac in the mid-size heart of the car market, and by waning Saturn.

There is apparently good news on GM’s ability to stop using ruinously expensive incentives. Lutz claims that the average transaction price compared to this time last year when bankruptcy loomed is up $6,000 to almost $31,800 compared to a a plus $3,000 industry average. GM’s actual status will become clearer in mid November when the private company returns to some type of non-GAAP financial reporting. Stay tuned.

In the meantime: “We are in the automobile business and people buy our cars, trucks and crossovers, and they only buy them because they are the best, or they are convinced they are the best value or the ones that suit them the best,” Lutz said.

The fate of the company is in potential customers’ hands.

GM has a lot to do before they can begin to sell cars. First Bondholders , Stock Holders, ( who had their stock changed to MTLQQ ), Vendors, and anyone else who lost, are now another market. Those who supported GM by buying products are no longer faithful.

I feel GM only looked at the Govt Money and not the long term effect. All the desolving should have started a long time ago. Then Govt money could possibly have been avoided. GM now is left with building a new market from future generations , years after we are all gone.

I am a small used car dealer in Maine. I deal in 5 to 10 year old cars and trucks. Almost every 2002 or older car I purchase has to have major brake line repair and rocker panel repair do to rust. I can buy Toyota, VW, Nissan, Honda and Subaru as old as 1998 and the average foreign vehicle has no rust issues in those years. Wake up GM if the foriegn competition builds it better for the same money what do you think the people will buy.