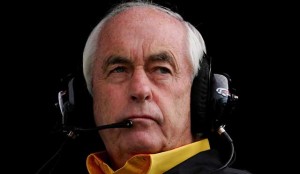

Roger Penske has a way of turning things to his own advantage. And the recently-concluded Cash-for-Clunkers program provided him yet another opportunity to work that corporate magic.

The Penske Automotive Group, run by the Detroit-based entrepreneur and motor sports legend, posted a solid 23% increase in third-quarter profits with the federally-funded program, designed to drive up domestic car sales, providing a significant boost.

The group’s net income came to $27.4 million, or 30 cents per share, up from $22.2 million, or 24 cents per share, the year before. Excluding one-time charges, earnings came to 34 cents a share, a bit ahead of analyst forecasts. Revenues fell 13%, to $2.6 billion.

The upturn reflects a variety of factors, including aggressive cost-cutting. But the Clunkers program, officially known as CARS, or the Car Allowance Rebate System, added significant momentum to Penske’s performance in several ways.

The group serves as the U.S. distribution arm for German automaker Daimler AG’s Smart minicar unit, which received a sizable number of new buyers under CARS, which provided rebates of up to $4,500 for motorists trading in on a more fuel-efficient vehicle. That helped offset what has been an otherwise bad year for Smart, which sells a 2-seat urban commuter car.

Even with the Clunkers boost, Penske noted Smart sales are down 32% for the year, and the unit is now expected to move just 15,700 cars. Original expectations called for sales to remain flat, despite the economic downturn.

Penkse’s diverse operations also include one of the nation’s largest auto dealer networks, with 310 individual auto franchises. In a prepared statement, the silver-haired executive noted that, “Our retail operations performed well during the third quarter, experiencing continued sequential improvement compared with the second quarter.”

There were some problems for Penske during the quarter. A month ago, the group was forced to abandon an ambitious bid to acquire General Motors’ Saturn division, one of four brands the giant automaker is abandoning as part of its bankruptcy reorganization. GM had said it would provide product only until 2012, but Penske’s bid to find an alternative supplier when French automaker Renault backed out of a proposed deal.

The Penske Automotive Group, based in the Detroit suburb of Bloomfield Hills, had to write down a $1.9 million charge because of the failure of the Saturn takeover effort.

Other major auto retail chains, such as AutoNation and Sonic Automotive, are posting improved earnings for the third quarter, also do to the CARS program. But the numbers could be significantly weaker for the next quarter, as the industry had a significant “payback period” of sharply lower sales once the Clunkers program wrapped up.

Retail auto sales are showing some signs of recovery, and could hit 10.7 million, on an annualized rate, in October, according to Mike Di Giovanni, chief market analyst for General Motors. But earlier this week, Di Giovanni cautioned that this still “isn’t great. It is a level we haven’t seen since the 1980s.”

With new government data showing the nation out of recession, but with the economy still expected to grow very slowly, investors have shown wariness about the near-term potential of various auto retail stocks.

This guy is a Kwame Kilpatrick supporter. He gave “The Thug” a big time loan (maybe) without paperwork. Guess the I.R.S. needs to be involved then because without paperwork as a loan it is then considered a “gift”.

You raise an interesting question, Tater. There were four folks involved in this “loan.” They claim they made it available to His Dishonor because it was the only way to get him to agree to leave office without an even longer fight. And then there’s Matty Maroun, the Canadian businessman, who claims he simply gave, I believe, $50,000 to Kilpatrick’s wife to help support the family while the big guy was in jail.

No matter if their motives truly were pure, they’re now being held up to ridicule and plenty of skepticism, and perhaps even some legal issues. It seems like the Big Salami hasn’t met anyone he couldn’t hurt through his behavior.

Paul A. Eisenstein

I find all of this loan business quite suspicious to say the least.

I will always go by the old saying “you are who you hang with”.

These guys like Penske and the others just might have some dirt on their hands when dealing with King Klown and The Posse of Detroit.

Karmanos for sure since he hired King Klown down in Covisint (Dallas) for the only reason I can think of: To have the bridge for health care reform money funneled by Momma Kilpatrick (Congress) for health records updating, thereby making Karmanos rich and Kwame as the salesman and his “commissions” in the money.