Resale value and vehicle quality have become increasingly important reasons for new-vehicle buyers to remain loyal to an automotive brand, according to the J.D. Power and Associates.

In its latest Customer Retention Study just made public, resale value as a reason for loyalty has increased by 12 percentage points in 2009, compared with 2008.

The importance of vehicle quality has increased by 6 percentage points. In comparison, in 2008, the reasons with the largest increases in importance for staying loyal to a brand were safety, fuel economy and deals/incentives.

The study measures the percentage of vehicle owners and lessees who replace a previously purchased new vehicle with another from the same brand.

If you just look at the industry average of less than 50%, it means that the average car brand has to find more than half of its sales from new people, an enormously expensive marketing challenge.

“Although there are some signs of economic recovery, the outlook remains uncertain, so for many new-vehicle buyers, high resale value and quality are particularly important considerations that are driving purchase behavior,” said Raffi Festekjian, director of automotive product research at J.D. Power and Associates.

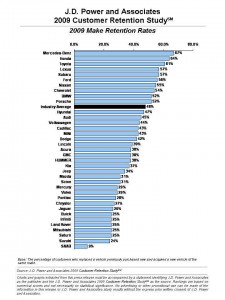

Mercedes-Benz ranks highest among automotive brands in retaining vehicle owners when they buy a new-vehicle, and improves its retention rate by 8 percentage points from 2008 to 67% in 2009. Following in the rankings are Honda (64%) and Toyota (61%).

Mercedes-Benz has steadily improved its customer retention rates during the past five years, and in 2009, has achieved the highest rate ever attained by a manufacturer since the inception of the study seven years ago.

Overall customer retention in 2009 has remained stable from 2008 at 48%. In 2009, 13 of the 36 ranked brands have improved in customer retention rates from 2008, while 20 have declined and three have remained stable.

Mini and Porsche post the greatest improvements in customer retention rates from 2008, each improving by 14 percentage points in 2009. For Mini, this improvement is driven primarily by incentives and customer perceptions of resale value of the brand’s models. For Porsche, the increase is due to resale value, fuel economy and quality.

The 2009 Customer Retention Study is based on responses from 128,939 new-vehicle buyers and lessees, of which 74,610 replaced a vehicle that was previously acquired new. The study was fielded between February and May 2009 and August and October 2009.