New-vehicle buyers are returning to dealer showrooms so far in March, lured by huge incentives, after Toyota recall news and bad weather kept them away in February.

March new-vehicle retail sales are projected to increase by 25%, compared with the same period one year ago, according to J.D. Power and Associates, based on transaction data from more than 8,900 dealers.

Retail transactions are the most accurate measurement of true underlying consumer demand for new vehicles, according to Power.

Most manufacturers’ retail sales are up so far in March, with Toyota, Ford and VW leading the major makers. Toyota appears to be rebounding – in both sales and market share – to its late 2009 levels.

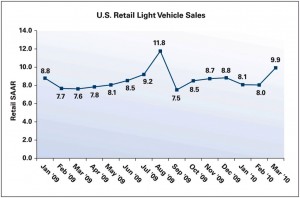

March new-vehicle retail sales are expected to come in at 883,300 units, which represent a seasonally adjusted annualized rate (SAAR) of 9.9 million units. This reflects a retail SAAR increase of nearly 2 million units, compared with February 2010. Compared with March 2009, retail sales are projected to increase by 2.3 million units.

“New-vehicle retail sales increased robustly during the first half of March, and are expected to remain strong throughout the remainder of the month—setting the industry recovery back on track,” said Jeff Schuster, executive director of global forecasting at J.D. Power and Associates.

“March sales could outperform projections if the pace does not level off as expected for the remainder of the month. However, there is some risk that the incentives offered by Toyota could spark an incentive war among several automakers. While this may lead to a temporary increase in sales momentum, it could also potentially slow the pace of long-term recovery.”

Total Light-Vehicle Sales

Fleet sales continue to increase from historic lows in 2009 and are projected to increase by 13% from March 2009 to come in at 209,000 units in March 2010. Total light-vehicle sales for March are projected to come in at 1,092,000 units—an increase of 23 % compared with one year ago.

March total SAAR is projected to reach 12.1 million units for the first time since September of 2008 – except for the boost provided by the CARS program in August 2009.

–

| U.S. Vehicle Sales and SAAR Comparisons – March 2010 Forecast | |||

| March 2010 | February 2010 | March 2009 | |

| New retail | 883,300 (+25% March 09) | 567,942 | 678,824 |

| Total sales | 1,092,000 (+23% March 09) | 778,617 | 856,137 |

| Retail SAAR | 9.9 million | 8.0 million | 7.6 million |

| Total SAAR | 12.1 million | 10.3 million | 9.7 million |

| Source: J.D. Power and Associates. Figures are forecast from the first 11 selling days of March. Percentage change is adjusted based on 26 selling days vs. 25 days one year ago. | |||

–