A New York radio station airing the Rush Limbaugh show this morning aired a commercial from General Motors Company announcing that it had made another payment to the U.S. government for taxpayer loans, which allowed it to emerge from bankruptcy last summer.

Limbaugh and other critics on the right widely derided the taxpayer bailout as creating an unwelcome “Government Motors.”

Moreover, right wing groups are boycotting GM products, but right wing oriented businesses are apparently accepting taxpayer money.

Polls before, during and after GM bankruptcy reorganization also show a majority of Americans as opposing the idea of government intervention in both the automotive and financial sectors.

GM had previously said it wished to pay another some more of $4.7 billion owed to the U.S. government ahead of time, possibly as early as June. Two billion dollars have already been returned. (About $C1.1 billion will also be repaid to Canadian and Ontario governments.)

GM Chairman and Chief Executive Edward Whitacre Jr. was to make the announcement this Wednesday at a media event in Kansas City where the Chevrolet Malibu is assembled.

Under the loan terms, GM has until 2015 to repay the cash part of the loan, but the automaker is pulling ahead its payments in the absence of any pre-payment penalties in an attempt to silence critics of its bailout.

Overall, this return of $6.7 billion is only a small portion of the actual amount due to taxpayers, who are on the hook for roughly $50 billion. For the balance, taxpayers own a 61% stake in the privately held company, and a successful public offering or IPO remains crucial to the government getting its money back. Multiple studies have said that taxpayers will never recover what was invested. See Taxpayers Will Take Big Losses on Auto Bailouts

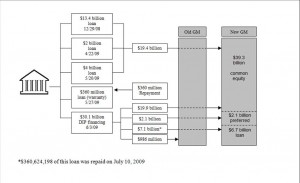

The value of General Motors Company used by the bankruptcy court estimated that the market capitalization (the price of all outstanding shares) of the new entity would be worth between $59 and $77 billion in 2012. Treasury has invested a combined $49.5 billion in the New and Old GM and holds on paper approximately 61% of equity in General Motors Company.

Assuming full repayment of an $8.8 billion note and preferred stock issued by the new GM Company to Treasury, the shares in General Motors Company will have to be worth $40.7 billion (the difference between $49.5 billion and $8.8 billion) for Treasury’s investment to be repaid when Treasury sells its shares

This means the market capitalization of the entire company needs to be worth $67.7 billion. In April 2008, when Old GM shares were at the height of their value (not adjusted for inflation), the company’s total value was only $57.2 billion.

“right wing groups are boycotting GM products”

That just show you how stupid some people are. That’s like putting all your money into McDonalds then eating at Windy’s. IF people want their money back then they need to buy GM cars. What’s so hard to understand about that?

You should realize that local radio stations air some of the ads, and the Limbaugh people have no idea. I have heard left-wing stuff like PETA advertised during conservative shows!

TAP: LOL at the very thought of PETA ads on conservative radio. Still laughing…