Well, fasten your seat belt – after two months of declining auto sales in the struggling U.S. auto market, it’s now predicted that new-vehicle retail sales will bounce back in July.

New-vehicle sales are expected to come in at 928,000 units this July, according to J.D. Power and Associates, which tracks actual dealer sales on a daily basis.

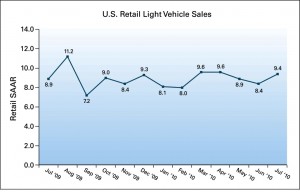

This makes for a seasonally adjusted annualized rate (SAAR) of 9.4 million retail units, a significant increase from June’s rate of 8.4 million units.

However, this is still far, far below the pre-financial-disaster boom years of more than 15 million annually. (See Oops! U.S. June Auto Sales Down Further)

Year-over year comparisons are difficult this month. Even though July’s SAAR selling rate is also up from the 8.9 million units posted in July 2009, last year the “Cash for Clunkers” program, aka CARS, kicked in.

“Consumers appear to be responding to the slight increase in visible incentive spending, which is expected this time of year during typical model-year sell downs,” said Jeff Schuster, executive director of global forecasting at J.D. Power and Associates.

“Even if the deals aren’t as strong as they have been in the past, consumers may be grappling with the notion that these deals are as good as they’re going to get. In addition, an increase in maturing leases and a less attractive used car market may be contributing to higher sales volumes,” Schuster concluded.

Even given the strength in retail sales in July, sales results for the remainder of the year are expected to be volatile. As a result, Power has revised its 2010 forecast downward slightly to 9.4 million units for retail sales from 9.5 million units, and 11.7 million units for total sales from 11.8 million units.

“Given the inconsistent nature of the current sales environment and the hurdles the recovering economy has yet to face, the rate of the recovery in auto sales is expected to be slower than previously thought,” said Schuster.

“This emphasizes the importance of the industry’s new cost structure, as sales are projected to be below the normal range of 15 to 16 million units for at least another two years.”

Retail transactions are the most accurate measurement of true underlying consumer demand for new vehicles, according to Power.

.

| U.S. Vehicle Sales and SAAR Comparisons – July 2010 | |||

| July 20101 | June 2010 | July 2009 | |

| New-vehicle retail sales | 928,000 units (2% higher than July 2009) 2 | 746,618 | 878,918 |

| Total sales | 1,076,300 units (4% higher than July 2009) | 981,429 | 995,977 |

| Retail SAAR | 9.4 million | 8.4 million | 8.9 million |

| Total SAAR | 12.2 million | 11.0 million | 11.2 million |

| 1Figures cited for July 2010 are forecasts based on the first 14 selling days of the month.

2The percentage change is adjusted based on the number of selling days (27 days vs. 26 days one year ago). Source: J.D. Power and Associates |

|||

.