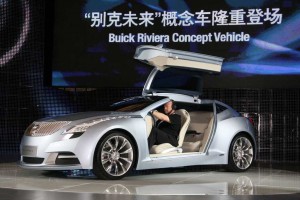

GM and SAIC will expand cooperation on future products. They've already developed a number together, including the Buick Riviera Concept.

General Motors and its Chinese partner, SAIC Motor Corp., have announced a potentially significant expansion of their decade-old partnership, one that could reach well beyond the fast-growing Asian nation.

The non-binding agreement calls for the makers, among other things, to cooperate on the development of “new energy vehicles,” such as the Chevrolet Volt plug-in hybrid. It also expands their joint effort to penetrate other emerging markets, such as India.

“Strategically, this is about GM getting a leg up in China without having to pay for it all on its own,” said Jim Hal, chief analyst with Detroit-based 2953 Analytics. The deal is also about expanding access to India, “which may mimic the huge growth we’ve seen in China in recent years.

But several observers, including sources within GM, tell TheDetroitBureau.com that the new venture may also be a quid-pro-quo for a possible investment by SAIC in the upcoming General Motors IPO. The maker, according to recent reports, will stage its long-awaited stock offering on November 18th, with shares to be offered at somewhere between $26 and $29. (Click Here for the full story.)

“The Chinese desperately want access to the technology we’ve been using in the Volt,” said a ranking executive involved in the U.S. maker’s electrification efforts. “But so far, anyway, we’ve been reluctant to share it with them,” he added, requesting anonymity because of his sensitive management position.

Whether SAIC actually will invest in GM could be a potentially hot potato for a company that survived last year’s bankruptcy only with a $50 billion federal bailout, and which has become known to critics as “Government Motors.” In light of this week’s elections, such a move by SAIC could be even more politically charged.

But expanding relations with SAIC, in other forms, is clearly something General Motors’ new management team sees as essential.

“GM sees this as in its best advantage,” said Michael Robinet, auto analyst with IHS. “SAIC certainly has plenty of strengths, and that could be leveraged in places like India. It could also add the scale that GM needs with its electric vehicle program.”

The relationship began 13 years ago, when former Chairman and CEO Jack Smith took the then-controversial step of former a joint venture with SAIC to produce Buicks at a plant in Shanghai. Today, GM is a close second to German arch-rival Volkswagen AG in the Chinese market, and has added a number of other joint ventures with SAIC.

Under the new Memo of Understanding, or MoU, the makers will cooperate on the development of “new energy vehicles,” along with an expanded role for their jointly-operated R&D center, PATAC, located in Shanghai.

The co-development of advanced powertrain components is under study, and the makers “anticipate” jointly developing a new vehicle platform, or “architecture.”

Significantly, noted a General Motors statement, “the MoU builds on the automakers’ efforts to explore cooperation in Asia’s emerging markets, led by India.”

The subcontinent is already one of the faster-growing market among the so-called BRIC economies – which also include Brazil and Russia, as well as China – and analyst Hall believes that, in the coming years, India could generate the same sort of high double-digit growth that has made China today the world’s largest national car market.

There are some potential downsides, however, observers note. In the strange-bedfellows world of Chinese business, SAIC also partners with VW. And the Chinese domestic maker has significant aspirations of its own and could, skeptics caution, eventually use the technology, platforms – and cash – generated by its ties to GM to undercut its American partner.