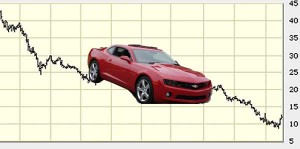

Is GM's once-Blue Chip stock ready to flatline?

It’s hard to believe that it was just last summer that former General Motors CEO Rick Wagoner was grumbling because his company’s shares had slipped below the $10 mark. A mid-July restructuring plan briefly buoyed GM shares, but it’s been largely a downward slide ever since.

He latest rumors of bankruptcy sent the giant maker’s shares tumbling, again, yesterday, though as of midday Tuesday, the market had seemingly caught its breath and driv GM stock back up by more than 8 percent.

“Conditions are extraordinarily unsettled,” Wagoner said, last July. “Frankly,” he concluded, “we’re just going to have to ride it out for awhile.” How long awhile is anyone’s guess.

By comparison, Ford is a veritable golden stock. Its shares have more than doubled, over the course of the last month, and are now running in the mid-$4.00 range. Of course, that’s still only about half its 52-week high, and barely a quarter of what it was trading for this time five years ago.

Take it back a decade and the numbers were even more shocking. With former CEO Jacques Nasser in charge – and making a concerted push to nudge Ford past its cross-town rival – Ford shares commanded a solid $37 and change.

But GM, you might painfully recall, was surging steadily towards the $100-a-share mark in the early months of the new millennium – more than double what Apple was trading for, at the time. Google wasn’t even a gleam in an investor’s eye, yet.

With their once-hefty dividends, Detroit stock used to be the bedrock of the classic blue chips. Will we ever see those days return? “It’s unlikely,” a senior GM executive confided in me, recently. “We’re caught up in an endless cycle,” one of fear and greed. If there’s a bit of momentum, those looking for a fast buck will buy in, hold until the shares jump a couple dollars, then bail out at the first bad news, sending shares tumbling.

And, unless until there’s some really steady, positive news, each peak seems to dip a bit lower and lower. For GM, getting the Obama Administration to approve its modified bailout bid – preferably without requiring a bankruptcy filing – would help. It’s hard to feel good about a stock whose value could be wiped out in a matter of weeks. For Ford, meanwhile, a clear upturn in sales and market share wouldn’t hurt.

But these days, it’s more about survival than propping up the blue chips. Institutional investors and those looking for steady, dividend-driven income are looking elsewhere and it’s unlikely they’ll be coming back.

As a Ford shareholder, I was very disappointed to see their annual shareholders meeting is in Delaware this year. Is the public affairs department asleep in Dearborn? With economic warfare in Detroit among the carmakers declared, why send dozens of executives at a tremendous cost to Delaware when there are numerous Detroit area facilities who could use this money for the shareholders meetings? More importantly, Ford would receive kudos from the American public for saving money. I believe GM’s shareholders meeting was also supposed to be in Delaware but was changed to Detroit.

Given the all time record loss last year, the watering of the stock by just issuing almost 500 million new shares, the huge company-threatening debt load, and the millions upon millions in compensation paid to the management team that produced these results, I don’t think they want too many shareholders present. The questions could be hostile.