Is the battery car market losing its juice? While it’s too soon to tell if the latest surge in gas prices has hit its peak buyers already seem to be rethinking the cost-benefit equation when it comes to plug-in hybrids, extended-range electric vehicles and battery-electric vehicles.

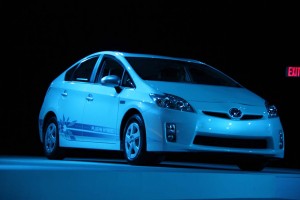

Indeed, were it not for the arrival of some new models, notably the Toyota Prius plug-in, the battery-car market might look like it was in risk of coming completely unplugged.

Total sales came to somewhere just north of 3,600, industry analysts estimate. The precise figure is hard to determine as Ford is not yet releasing numbers for its new Focus Electric, nor are smaller makers like Fisker Automotive and Coda providing data.

For the four makers that are providing sales numbers, the total for April came to just over 3,500, compared with 3,800 in March. That works out to barely 0.3% of the total new vehicle market in April.

The most severe slump comes at Nissan which sold just 370 of it Leaf battery-electric vehicles, or BEVs, in March. That’s down from 579 in March and an average of roughly 1,000 a month during the latter half of 2011. It was Leaf’s weakest showing since the first few months after its December 2010 launch other than in the immediate aftermath of last year’s devastating Japanese earthquake and tsunami.

And it raises serious concerns about whether Nissan will be able to approach its 20,000 sales target for all of 2012.

Company officials insist the downturn is a temporary aberration, the result of shifting more of the battery cars to new markets opening up around the world. The real test could come late this year when Nissan launches production of the Leaf on a new line at its Smyrna, Tennessee assembly complex.

Chevrolet outsold its Japanese rival by nearly four-to-one last month, buyers snapping up 1,462 of the Chevy Volt plug-ins, but that was down sharply from March when the Volt hit its highest sales mark yet at 2,289.

Some of the decline may be the result of a 5-week shutdown at the Detroit plant building the Chevrolet Volt. The maker insists it is seeing a build-up of demand in California where it has belatedly introduced a version of the plug-in that qualifies for the coveted High-Occupancy Vehicle – of Commuter – Lane sticker.

Nonetheless, it will now be a struggle for Chevy to reach the roughly 40,000 mark it had originally targeted for Volt this year.

For the month, the strongest seller was the latest addition to Toyota’s Prius “family,” its first-ever plug-in. Demand hit 1,654, nearly 200 units more than for the more expensive – but longer-range – Chevy Volt. Toyota sold 898 of the Prius Plug-in models in February and March when it began rolling into U.S. dealer showrooms.

The only other player to provide sales numbers was Mitsubishi. Its tiny i battery-electric vehicle generated 79 sales in April and just 215 for all of 2012 to date.

Ford’s reluctance to provide data on the Focus Electric might reflect the extraordinarily slow launch of the BEV. The maker delivered a handful to California dealers in late 2011 allowing it to meet a target of launching the vehicle before year-end, but production has been at a painful crawl and isn’t expected to ramp up much before mid-year, based on comments officials have been making.

Nonetheless, the Focus Electric got a big charge-up last weekend when it served as the first-ever battery-electric vehicle to pace a NASCAR race.

Sales of Ford’s other BEV, a version of the small Transit Connect commercial vehicle, have short-circuited due to the bankruptcy of Azure Dynamics, the Canadian firm that was converting the vehicle to battery power.

The weak April sales numbers could be worrisome to industry officials preparing to launch a range of additional electric vehicles in 2012. That includes several Ford plug-ins, including a version of its C-Max people mover, the Toyota RAV4-EV, a battery-electric version of the Honda Fit and the new Model-S, the first relatively mainstream offering from California start-up Tesla Motors.

What’s behind the slowdown? Industry analysts suggest the biggest problem is cost. Even with federal tax credits that can shave up to $7,500 off the purchase price battery cars carry a stiff premium. They also require compromises when it comes to range and performance. And it could prove an even tougher sell if fuel prices begin to settle back after their spring run-up.