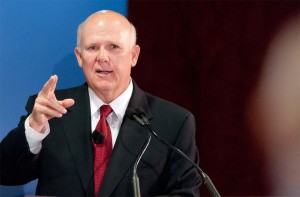

The unsettled economic climate in Europe has undermined General Motors’ efforts to revitalize the company’s operations, GM Chairman and Chief Executive Officer Dan Akerson said Tuesday.

Fixing GM’s operations in Europe remains the company’s top priority, added Akerson following the maker’s annual meeting. He noted GM of Europe has succeeded in striking new labor agreements with unions in both Poland and Great Britain and is “talking with unions in Germany” about possible concessions that could prove critical to GME’s turnaround.

Analysts believe the maker would like to close at least two of the plants operated by its European Opel brand but taking such a drastic step would be difficult without union cooperation due to laws that generally limit plant closures and job cuts. Meanwhile, speaking with reporters, Akerson said GM sees cost-cutting as just one step in the European turnaround effort.

“Underscoring our commitment to Opel, we’re investing billions in new models like the Mokka, which is the first contender from a German manufacturer in the growing sub-compact SUV segment. We’re making this investment even as we address overcapacity and high fixed costs in the region,” Akerson noted.

But few expect GM to get very far without cutting its capacity which is far beyond what demand is expected to reach anytime in the near future. While GM has won concessions in Poland and the U.K. Germany’s more militant IG Metall has been far less receptive to GM’s overtures. Akerson declined to say whether the automaker’s board of directors was preparing to announce the closure of a German assembly plant, but it is widely expected that its plant in Bochum is a likely target of the ongoing European re-structuring effort.

The goal is to maximize use of remaining facilities, said Akerson, noting the goal with “our next-generation Opel Astra…is to build it…in two plants running three shifts, instead of operating three partially-full plants like we do today. There also is our new alliance with Peugeot, which is designed to reduce our commodity costs and streamline logistics,” he said.

GM had hoped its European operations would be back in the black by 2011 but they instead went $700 million into the red. But while Europe is perhaps the company’s biggest near-term worry, Akerson said he is looking at cost-cutting throughout the global General Motors empire.

“We had a good year. Not a great year (in 2011),” he said, citing the company’s record profitability.

The former telecomm industry executive said a stricter cost discipline has driven changes in everything from the way GM buys advertising to the size and deployment of its corporate staff to how it operates our factories.

“We’re probably 25 percent of the way there,” Akerson said when asked how far along GM has come in its efforts to minimize costs and maximize margins.

He noted the company is cutting between $200 million and $400 million from its advertising budget, suggesting that, “Some of that will go to bottom line, but some of that will be re-invested so we can create more impressions.”

Akerson also said he has had no discussions with the Obama administration about the potential sale of the remaining roughly 32% stake in the company still owned by the U.S. Treasury. That topic has become a hot issue pitting President Barack Obama and GOP challenger Mitt Romney, who has said, in recent days, he would sell the stake as soon as possible if he were voted into the White House next November.

At the current stock price, which is hovering around $22 a share, the Treasury would lose as much as $40 billion. That would be cut in half if GM stock simply climbs back to the level of its November 2010 IPO, however, and the deficit would be wiped out at around $55 a share, not far off from where some analysts still believe GM’s stock could eventually climb.

Separately, when asked if GM might extend the recently-announced plan to buy out the pensions from thousands of white-collar retirees, Akerson said it is possible the company also may offer to buy out the pensions of the company’s hourly worker, provided it can reach an agreement with the United Auto Workers.

“We discussed it with them In broad terms last year,” he revealed, though he said the company has not followed that with any formal discussions with the union recently.