It’s the Chinese take on the old good-news/bad-news phenomenon: Chinese car sales rebounded sharply in May after a worrying slowdown earlier in the year. But to help build momentum, dealers have been slashing prices which could translate into lost profits for market leaders like General Motors and Volkswagen.

The sharpest price cuts in several years raise fears that the Chinese car market is weakening – along with the rest of the economy – and could go into a slump if manufacturers decide to hold the line rather than accelerate the current pace of discounting.

Chinese car sales surged 16% in May compared to year-earlier volume, a welcomed turnaround from the first quarter of 2012 when the market showed an unexpected and unfamiliar decline. But even so, sales for the first five months of the year were up only a modest 1.7%. Based on patterns throughout most of the past decade that might have been expected to be more like a 20, 30, even 40% gain.

The automotive market has been impacted by a variety of factors, including the elimination of several government incentive programs. But the more worrisome issue is a general slowdown in the Chinese economy.

That has hit the automotive market hard even as manufacturers continued ramping up production. Ford, for example, has laid out plans to double capacity over the next few years, with Nissan outlining a similar goal. General Motors is also boosting capacity in a bid to more than double sales to 5 million annually by mid-decade, up from 2 million in 2011.

Meanwhile, automakers are also pushing dealers to stock up on a variety of products targeting new and emerging market segments, including SUVs — which have not been a major factor in the Chinese market until now.

The result has been a glut of products on dealer lots – the typical showroom now carrying two months of inventory, up from 45 days just a month earlier. And that’s triggered an aggressive round of cost-cutting.

Price cuts aren’t entirely unheard of in China. During earlier years, makers frequently trimmed costs as they ramped up production – and as competition grew – passing savings along to customers.

But the latest cuts saw retail prices fall an average 1.1% in May compared to the month before — the biggest decline in two years — according to the National Development and Reform Commission which monitors vehicle pricing trends.

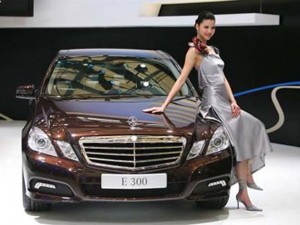

Meanwhile, Chinese media has been awash with reports of even sharper cuts in certain segments. Mercedes-Benz, for example, was trimming the price on some S-Class models by as much as 25% in recent months. And while he stressed that BMW price cuts “were not nearly as severe,” the maker’s global marketing chief Ian Robertson acknowledged it also was facing strong pricing pressure.

“The market is deteriorating quickly,” said Vivien Chan, an analyst with Hong Kong-based SinoPac Securities Asia Ltd., told the Bloomberg news service. “Price declines are no doubt adding more pressure on auto dealer stocks.”

During the Beijing Motor Show last month GM China CEO Kevin Wale told TheDetroitBureau.com he still believed the market would see growth in the 8% to 10% range for all of 2012, a figure echoed by most other senior executives gathered at the show willing to make predictions.

But that could prove entirely too optimistic, leading to serious problems in the months to come.

“We think this is a very dangerous strategy of the (carmakers) stuffing the dealers in the hopes of selling more,” Ole Hui and Jeremy Yeo, Hong Kong-based analysts at Mizuho Financial Group, wrote in a report.

If he is right, he warned that manufacturers “are due for payback time and we may see production cuts and thus weaker wholesale sales.”