"Candidly, we only want to do this once," said Henderson on the latest restructuring plan.

General Motors this morning revised its viability plan by cutting four brands by the end of this year or next, and eliminating at least another 8,000 jobs. It also proposed an exchange offer to bondholders to swap shares of GM common stock for outstanding notes, which would give them 10% of a reorganized GM.

The balance of the GM proposal effectively nationalizes the company and leaves the U.S. Treasury Department and the United Auto Workers union in control of almost all the shares of the new GM.

GM desperately needs to clear up the uncertainty about its future as soon as possible, since potential buyers are avoiding buying its cars, deepening its already grave revenue shortfalls. The longer the threat of bankruptcy remains in public view, the more likely that it will happen — the classic vicious cycle.

“We are taking tough but necessary actions that are critical to GM’s long-term viability,” said Fritz Henderson, GM president and CEO. “Our responsibility is clear – to secure GM’s future – and we intend to succeed. At the same time, we also understand the impact these actions will have on our employees, dealers, unions, suppliers, shareholders, bondholders, and communities, and we will do whatever we can to mitigate the effects on the extended GM team.”

Significant changes include:

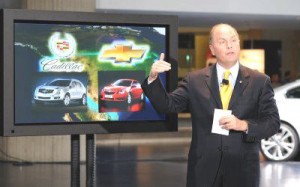

- A focus on four core brands in the U.S. – Chevrolet, Cadillac, Buick and GMC – with fewer nameplates and a “more competitive level of marketing support” per brand. Pontiac will be phased out by no later than 2010.

- A more “aggressive” restructuring of GM’s U.S. dealer organization “to better focus” dealer resources for improved sales and customer service. GM anticipates reducing its U.S. dealer count from 6,246 in 2008 to 3,605 by the end of 2010, a reduction of 42%, a further reduction of 500 dealers, and four years sooner, than in its February plan.

- Improved U.S. capacity use through “accelerated idling and closures” of powertrain, stamping, and assembly plants. Three additional plants will be closed.

- Lower structural costs, which GM North America (GMNA) projects will enable it to be profitable before taxes and interest at a U.S. total industry volume of approximately 10 million vehicles. This rate is substantially below GM’s previously unrealistic assumptions, rejected by Treasury in March, of annual vehicle sales rates in the U.S. market above 12.5 million units, and is down from the 15-17 million actual rates from 1995 through 2007.

- The elimination of another 7,000 union jobs in North America, with more unspecified cuts in white collar workers.

The debt-for-equity exchange offer applies to $27 billion of GM’s unsecured public notes. GM is offering to exchange 225 shares of GM common stock for each $1,000 equivalent of principal amount of outstanding notes of each applicable series. GM expects that $24 billion of the debt needs to be swapped for it to meet Treasury requirements for a healthy balance sheet. Bondholders would have 10% of GM shares if the proposed offer goes through. GM also wants Treasury to swap $10 billion of its GM debt for equity in the new company.

It appears from looking at the proxy statement that if the swap is accepted, and the UAW accepts GM shares for 50% of the money due to its health care plan, than 89% of a restructured GM would be held by the UAW and the U.S. Treasury, since GM wants Treasury to also swap some of its GM debt for equity as well. GM is also requesting that Treasury would then tender some of its shares over to the new company. This all still needs to be negotiated with bondholders, and then approved by the Obama Administration. But, depending on how this works out, GM would be a nationalized company. This, of course, is precisely what happened at AIG, at a far higher cost of $170 billion to taxpayers.

If GM does not receive enough tenders to consummate the exchange offers by June 1, 2009, GM expects to seek relief under the U.S. Bankruptcy Code. This appears to be a likely scenario, given the previous reluctance of bondholders.

GM is considering its alternatives in seeking bankruptcy relief in consultation with the U.S. Treasury, now GM’s largest lender. If GM seeks bankruptcy relief, “noteholders may receive consideration that is less than what is being offered. It is possible that such holders “may receive no consideration at all for their notes.” Thus the gauntlet is flung to the group that is holding up the restructuring. At mid-day GM bonds were trading at ten cents on the dollar.

GM says it now has lowered its breakeven point by cutting its structural costs “faster and deeper” than had previously been planned. Looking at the major areas of the revised plan, here’s a summary:

- Manufacturing: GM plans to reduce the total number of assembly, powertrain, and stamping plants in the U.S. from 47 in 2008 to 34 by the end of 2010, a reduction of 28%, and to 31 by 2012. This is an acceleration of six plant idling/closures from the February 17 plan. Throughout this transition, GM says it will continue to implement its flexible global manufacturing strategy (GMS), which allows multiple body styles and architectures to be built in one plant.

- Employment: U.S. hourly employment levels are projected to be reduced from about 61,000 in 2008 to 40,000 in 2010, a 34% reduction, and level off at about 38,000 starting in 2011. This is a cut of an additional 7,000 to 8,000 employees from the February Plan. GM also anticipates a further decline in salaried and executive employment.

- Labor costs: The Viability Plan assumes a reduction of U.S. hourly labor costs from $7.6 billion in 2008 to $5 billion in 2010, a 34% reduction.

As a result of these and other actions, GM North America’s structural costs are projected to decline 25%, from $30.8 billion in 2008 to $23.2 billion in 2010, a further decline of $1.8 billion by 2010 versus the February Plan.

If the latest plan goes through, then a restructured GM could return to profitability as soon as 2010, if, big if, it can hold the line on its sliding U.S. market share.

GM Bond Exchange Offers Listing Approved in Europe

DETROIT, 28 April 2009 – The United Kingdom Listing Authority has approved a prospectus to be published by General Motors Corporation in certain jurisdictions in the EU for GM’s exchange offers and consent solicitations in which GM is offering to exchange 225 shares of its common stock for each 1,000 U.S. dollar equivalent principal amount (or accreted value as of the settlement date if applicable) of its outstanding notes of each series set forth in the prospectus and is offering to pay, in cash, accrued interest on such notes from the most recent interest payment date to the settlement date. In respect oof the exchange offers for the notes issued by General Motors Nova Scotia Finance Company, GM is jointly making the exchange offers with GM Nova Scotia.

The exchange offers are a vital component of GM’s overall restructuring plan to achieve and sustain long-term viability and successful consummation of the exchange offers will allow GM to restructure out of bankruptcy court.

The prospectus today was passported under European regulations to France, Germany, Belgium, the Netherlands, Luxembourg, Austria and Spain. If you are a resident in countries other than the above (including the United States and the United Kingdom), you may or may not be eligible to participate in the exchange offers and consent solicitations pursuant to the laws of the country in which you reside. Please contact D.F. King, the Solicitation and Information Agent, to assist you in determining your eligibility. The prospectus has also been passported to Italy, but the exchange offers in Italy are subject to clearance by CONSOB pursuant to Article 102 onwards of Legislative Decree No. 58 of February 24, 1998. Therefore, the exchange offer period in Italy will only commence following such clearance.

The prospectus contains or incorporates by reference important information which should be read carefully before any decision is made to participate in the exchange offers and consent solicitations. Noteholders in Italy, France, Germany, Belgium, the Netherlands, Luxembourg, Austria, Switzerland, Spain and the United Kingdom (and certain other qualifying holders in other jurisdictions) may access the prospectus for free at GM’s website at http://www.gm.com/corporate/investor_information. Any requests for copies of this prospectus or related materials should be directed to the Solicitation and Information Agent at: D.F. King ( Europe) Limited, One Ropemaker Street, London EC2Y 9HT, Banks and Brokers call: +44 20 7920 9700 All others call toll free: 00 800 5464 5464 Email: gm@dfking.com.

Try buying a car through the GM Credit Card Program (Credit Card HSBC). My parents had aquired a GM Credit Card HSBC which accumulated points with purchases which then could be used for the purchase of a car. My Parents had settled on the Malibu by Chevrolet and before they could buy it, my dad became ill and died (April 3). My mother notified the ususal people(Soical Security, Banks,Credit Cards, etc) and HSBC promptly canceled her card taking her accumulated points away. After contacting HSBC China call center and speaking with someone who could not speak English, and therefore could not help me, I called GM and was told that GM does not have anything to do with with the GM card program. But on their web site it states “GM corporation is responsible for the operation and administration of the Earnings Program”. Could someone please tell me what is going on with the GM card program? You have a person willing to purchase a vehicle, but is getting the run around about getting the points earned!`GM will keep cutting back until it is no more.