Yes, you probably will pay more for that new car, truck or crossover you’ve been eyeing. With U.S. sales rising and factories, in many cases, stretched to the limit manufacturers have been curbing incentives and nudging prices higher, according to industry analysts.

The good news is that whatever you buy, your next new vehicle is likely to be significantly better-equipped than the product it replaces, reports J.D. Power and Associates.

Anyone watching the Olympics might get the impression this is a great time to buy, at least if a low price tag is the objective. Chevrolet, in particular, has been heavily promoting its “Total Confidence Pricing” program, implying that all buyers are getting an especially low-ball number. Other makers have been pitching low-interest loans and other givebacks to get shoppers into showrooms.

But the deals aren’t as good as they might first seem, according to Jesse Toprak, chief analyst with TrueCar.com. “Even though automakers may give the impression that they are ramping up incentives spending….(they) are increasingly moving away from cash incentives and pushing finance and lease programs,” he said.

The research firm’s data underscores the trend. Only a handful of manufacturers – notably including Honda, Nissan and Volkswagen, are offering bigger incentives than a year ago. VW’s givebacks were up 38.1% in July compared to a year before, Nissan 22.4% and Honda 12.8%. The majority of makers sharply curtailed givebacks – Toyota by a whopping 22.5% year-over-year. The industry, on the whole, decreased incentive spending by 3.7%.

It’s not surprising considering that the U.S. motor vehicle market has seen a strong resurgence in recent months; despite the overall malaise of the American economy most analysts and automakers have revised their full-year 2012 forecasts upwards to as much as 14.5 million, the best numbers the industry has seen since well before the car market’s recession-led collapse.

In turn, most makers – especially the Detroit Big Three – rationalized capacity during the economic downturn, a number of plants closing as makers struggled to make sure the remaining facilities were operating at peak. Now, however, as sales revive faster than originally anticipated, they are struggling to meet demand. And that means it is more of a seller’s market than it has been in years.

Hyundai — which has the lowest incentives in the market, at an $1,181 a vehicle – is warning it will likely lose market share this year because it can’t keep up with demand for new products like the Azera, Genesis Coupe and Veloster Turbo.

The average giveback in July for all makers was $2,480, with Nissan leading the way at $3,205 – ahead of normal giveback leaders General Motors, at $3,015 and Chrysler, at $3,132.

But incentives tell only part of the story. Maker are also raising prices – in part to recover the cost of steadily increasing levels of new content but also to catch up after having restrained the urge to raise prices during the recession.

Higher prices and lower incentives translate into customers paying more for the typical vehicle – though exactly how much prices are going up is a matter of interpretation.

“There is still a lot of affordability in the market,” contends Bill Fay, the new Toyota Division General Manager, though he admitted that customers may wind up paying for “a lot of innovation” that the industry is bringing to market.”

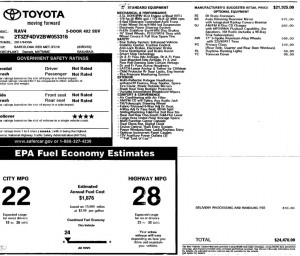

From 2008 to 2011, J.D. Power and Associates found average transaction prices jumped from $25,505 for the typical U.S. vehicle to $28,337. TrueCar, meanwhile, said its dealer tracking data indicates the average vehicle went for $30,369 in July, a 1.6% rise compared to the same month last year. Due to differences in how the figures are calculated there’s a gap between the numbers reported by the two firms – and Power shows a slightly lower surge in prices in 2012 — but most observers believe the trend towards higher transaction prices is clear.

Other reasons behind rising prices include a general upgrade in vehicle equipment and technology “across the board,” according to David Sargent, automotive operations direct at J.D. Power. That’s significant at a time when buyers are downsizing in large numbers. On the positive side, he says, “The average compact car today is as good as the midsize car a person might now be trading in.” But the smaller car’s price may be closer to what was paid for the bigger vehicle in the past.

Industry planners nonetheless recognize there’s a classic link between pricing and demand, says Jim Hall, an automotive consultant with 2953 Analytics. But they may have no choice but to ask for more. There’s not only the higher content level but the reality that even basic commodities, such as steel and rubber, have seen sharp price increases in recent years.

“It’s inevitable” that costs are passed on, says Hall. The question is whether that will result in lower sales of new vehicles. To a small degree price hikes will impact the market, he adds, “but there are other issues,” including the broader state of the economy.” Job fears are more likely to keep buyers out of the new car market than a 1.6% jump in a vehicle’s average transaction price.

There’s also the reality that today’s vehicles are lasting longer. Several new reports indicate the typical new car customer may now wait as long as 10 years before trading in – and the majority are clocking between 125,000 and 150,000 miles on the odometer before then, according to a study by the Black Book vehicle pricing guide.

(Car owners waiting longer than ever to trade in. Click Here for that report.)

With buyers likely to wait longer to trade in automakers have even more reason, some observers suggest, to want to maximize profits on every sale.