If you’re wondering what impact rising fuel prices have had on automotive sales this year consider that the Toyota Camry has displaced the perennially best-selling Ford F-Series at the top of the chart.

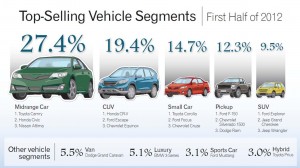

So-called “midrange” cars dominated the market during the first half of the year, according to a new study of vehicle registrations by Experian Automotive. In fact, five of the top 10 vehicles were midsize sedans, including not only Camry but the Ford Fusion and Nissan Altima. There also were two compact sedans and a compact SUV.

But don’t rule out big trucks. The F-Series is only a hairsbreadth behind Camry and could yet land as the nation’s best-seller for the full year, according to Experian, continuing a nearly three-decade-long domination. Rounding out the top 10 was another full-size pickup, the Chevrolet Silverado. And while they didn’t come close to the top, hybrid vehicles definitely made some significant gains early in the year.

Vehicle registrations during the first half of the year rose 11.9%, noted Experian’s director of analytics, Jeffrey Anderson, who called lower incentive rates and increased dealer incentives “great motivators” to get consumers back into showrooms.

But he also noted that, “higher gas prices and new model redesigns could be pushing consumers to look at small to midrange cars, instead of the larger vehicle segments.”

Other analysts might add another factor to that explanation: the rapidly expanding list of new products in the passenger car market, especially the midsize segment. Barely a year after Toyota unleashed its all-new Camry new entries for 2013 include complete redesigns of the Altima, Fusion and Accord. There are plenty of new offerings in the compact segment, as well, such as the all-new Dodge Dart.

There seems to be a direct link between gas prices and sales of fuel-efficient vehicles, a separate study by the University of Michigan Transportation Research Institute showing that the average mileage of the vehicles American buy is going up-and-down on a monthly basis almost in lockstep with pump prices.

(For more on that story, Click Here.)

But the market for big trucks isn’t solely driven by fuel costs. It’s also linked to the health of the nation’s economy, analysts stress. The bulk of the so-called “personal use” market has gone away. A large bulk of big truck buyers use their vehicles for work, so recent growth in demand suggests they may be more optimistic about the nation’s economy.

While the F-Series was the second highest-seller between January and June, Experian pointed out that the Ford truck dominated in 19 states – including Texas which made up more than 17% of the pickup’s total U.S. sales. Camry was number one in 13 states – including California where 13% of the midsize sedans were sold.

As for the vehicles posting the fastest growth in registrations during the first half? The midsize Kia Optima gained a whopping 92.7%, according to Experian.

But hybrids showed the biggest collective growth, the number of gas-electric vehicles registered between January and June jumping by 61%.