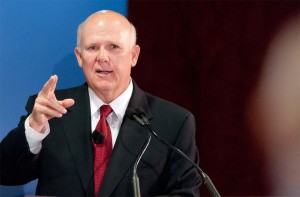

GM Chairman and CEO Dan Akerson has made it clear he wants the government to sell off its stock ASAP.

It may soon be “Government Motors” no more.

While the White House has set a deadline of April 2014 to sell off all its remaining shares of General Motors, it appears to be racing to meet that target sooner than expected, the Treasury selling off nearly $490 million in stock last month, according to a report provided to Congress.

But at the price taxpayers received – anywhere from $26.19 to $29.36 per share – that could mean an eventual loss on the 2008 – 2009 GM bailout of billions of dollars.

At one point, the U.S. Treasury held a majority stake in GM, prompting critics of the bailout to deride the maker as “Government Motors.” Some right-wing pundits went so far as to call for a boycott of GM products, along with those from Chrysler, which also received federal assistance.

The smaller maker has paid off its remaining federal debt, though its Italian partner Fiat SpA is still negotiating to take over any remaining shares it doesn’t hold in the U.S. maker.

GM and the government began parting ways after a November 2011 IPO that set a price of $33 a share. Following the stock offering the government remained the maker’s largest stakeholder but in January, the Treasury put another large chunk of its GM holdings on the market announced plans to sell off the remaining stock by early 2014.

As with any stock, the price the government can command varies widely, often within the same day – though GM shares have rebounded significantly from mid-2012 when the market had bottomed out and the maker was getting as little as around $19 per share.

Nonetheless, analysts estimate the government’s remaining stake – around 277 million shares – would have to roughly double in price to fully recover the $49.5 billion invested in the then-bankrupt maker. With February’s stock sell-off, the Treasury has recovered about $29.8 billion so far. At the price range experienced in February, the remaining shares could generate around $8 billion, leaving a loss of $7 billion to $8 billion.

The Obama Administration and other supporters of the bailout – which was actually initiated by former Pres. George W. Bush – contend that is a small price to pay compared to allowing GM to collapse. Initial forecasts warned that as many as 1 million U.S. jobs would be lost – along with billions in federal, state and local taxes. The Obama White House also warned that such a failure could have driven the faltering economy from recession into depression.

The maker has recovered significantly since emerging from Chapter 11 protection, as of December 2012 posting 12 consecutive quarterly profits that reversed an even longer string of multi-billion-dollar losses. GM has also added or announced plans to add more than 10,000 U.S. jobs since mid-2009.

Company officials clearly want to get back to being a fully independent company, though Chairman and CEO Dan Akerson has repeatedly emphasized that the feds have avoided any involvement in GM’s day-to-day business. But the maker still faces some oversight, notably limitations on the salaries of key executives including Akerson. He is currently the lowest-paid of the Detroit Big Three CEOs and apparently pulled back on plans to request a 20% increase because of controversy in Washington over the pay for execs at companies that received federal bailouts.

This is ABSOLUTELY NOT RIGHT!

I supported a proper and fair LOAN to the car makers to retian U.S. jobs. I didn’t agree to give money to any car company nor to have them use U.S. tax payer money to expand their business operations in CHINA as GM has done.

I hope the media reports this bilking of U.S. tax payers and that GM is forced to repay the money lost by the stock sale. Just as investors can sue for corporate fraud, tax payers via the U.S. gov should be suing GM to collect all funds plus interest and legal costs. Tax payers should not be exploited for the benefit of GM or any other company.