Ford has plenty of jobs open. Now it needs to find the right candidates - but that isn't as easy as in the past.

Ford Motor Co. hopes to hire about 3,000 engineers and other professionals this year a third more than originally planned — but standing conventional wisdom on its head, the Detroit maker is finding it difficult to come up with enough ready, willing and able white-collar workers to fill all those spots.

And it’s not alone. Cross-town rivals General Motors and Chrysler have been trying to re-fill their own employee ranks decimated by cutbacks during the Great Recession, as have scores of automotive suppliers. But a surprising number of those slots remain open for lack of qualified talent.

“It’s much more difficult getting the right people” than it was in decades past, laments Felicia Fields, group vice president of Human Resources for Ford, reflecting a shift in “the type of people” the automaker needs in an era when high technology systems have become as much a part of today’s vehicles as traditional, mechanical devices.

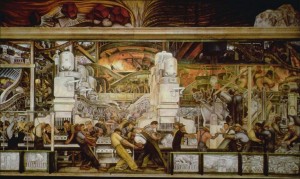

As this Diego Rivera mural from the Detroit Institute of the Arts suggests, you once needed little more than muscle to work in the auto industry.

Just ask Graydon Reitz, head of Ford’s Global Electrical and Electronics System Engineering operations. His group is responsible, among other things, for the development of the Ford Sync and MyFord Touch infotainment technologies. Such systems have become a key differentiator in today’s auto industry and making them work right is just as demanding, he contends, as the latest software for an Apple or Android smartphone.

“It’s a very different set of skills we need now compared to what was” needed in decades past when a Ford engineer was more likely hired because of mechanical skills like engine design or the ability to configure sheet metal stamping dies.

Reitz’s unit alone has been hoping to hire 160 engineers this year but has so far been able to snag just 80. Overall, Ford began 2013 looking for 2,200 new white-collar workers, about 80% for its engineering operations. It has since increased the headcount hunt to 3,000, according to HR chief Fields, and has plenty of slots left to fill.

“It’s more difficult, more complex,” she says, and not just because of the different skill set workers may need in today’s auto industry. The problem is that Ford is no longer just competing for talent against the likes of GM, or even Volkswagen or Toyota, but also against consumer electronics firms ranging from Apple to Google to Dell.

It has to convince some skeptical prospects that the auto industry can offer as much of a challenge as Silicon Valley, while also trying to promote Detroit as an appealing home base – something that can be particularly challenging at a time when the Motor City is in the midst of the largest municipal bankruptcy in American history.

On the positive side, electronics group chief Reitz has found that many tech industry veterans are open to new opportunities and also find appealing the much lower cost of living in Michigan where a sprawling suburban home close to work can cost lost than a single-bedroom apartment over an hour’s commute away from a Mountain View or Palo Alto office.

But simply finding the right candidates has required Ford’s headhunters to learn new tricks. Forget Help Wanted signs or ads in local newspapers. They’re turning to social media outlets like Linked-In, Facebook and even Pinterest, notes Fields.

While neither Fields nor Reitz will discuss specific pay packages, they acknowledge that Ford has had to accept the fact that compensation packages need to be competitive with the often lucrative deals Silicon Valley and other high-tech centers have been paying.

It’s not just on the white-collar side of the employment aisle that things have changed, incidentally. In the heydays of Detroit it was said that anyone with a warm body could get a job on an automotive assembly line, no matter how little their education.

These days, that’s no longer the case. While someone may be able to still find the occasional opening with just a high school diploma, more and more assembly line prospects are being vetted for advanced education, whether college or technical training that enables them to understand the more complex tasks involved with today’s quality-focused duties.

The auto industry’s increased focus on high technology means that many of the workers displaced by the Great Recession won’t be able to go back to work at Ford or one of its competitors – not without extensive retraining.

Between 2006 and 2009, Ford eliminated 13,000 white-collar jobs in the U.S. It has since slowly begun ramping up the workforce and after bringing in 1,850 new salaried employees last year it now has a workforce of around 28,000 professionals. So, even with the additional 3,000 coming aboard in 2013, its ranks are well below pre-crash levels.

There’ll be more jobs opening up in the future, Fields promises – though she quickly adds that additional opportunities will only be made available as Ford’s sales continue to recover from the worst economic downturn the U.S. auto industry faced in decades.

Why would talented engineers want to work in an industry that disposes of them on a whim so that the executive staff can continue to receive multi-million dollar base salary plus even larger annual bonuses?

I totally agree with you. Especially when the company so mismanages their money they have to have the government bail them out. There are a few jobs that I got laid off from that I would never go back to just because of this kind of thing…or if I did, they’d have to pay me so much it wouldn’t be worth it to them.

Maybe they should take a cue from other companies and hire all temps and contract workers…that way when the next big recession hits, all they have to do is cancel the contract or tell the temps not to come in anymore. Problem solved.