When it comes to buying a new vehicle, many folks are shopping by price. However, it’s not only the monthly payment that buyers should consider, but also the operating costs because often they’re what has owners digging deeper into their pockets for more money on a regular basis.

The 2013 AAA Your Driving Costs report shows that if you drive a typical family sedan, such as a Ford Fusion, it’ll cost you more than $9,000 to operate that car for one year. Have a big SUV? Make it $11,600 per year.

The study takes into account a variety of factors such as fuel costs, insurance costs, depreciation and other expenses. Fuel costs were based on $3.486 per gallon, the late-2012 U.S. price from AAA’s Fuel Gauge Report. Fuel mileage is based on Environmental Protection Agency fuel-economy ratings weighted 60% city and 40% highway driving.

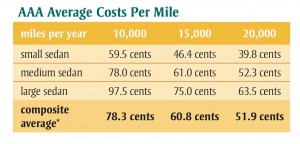

Need an easy way to cut your monthly operational outlay when buying a new vehicle? Simply buy the next size down. It’ll save you $2,000 each year, if you drive 15,000 miles a year.

“In the showroom it might be a $5,000 difference, but in the long term it’s a five-figure difference,” said Michael Calkins, manager of technical services for AAA.

(GM changed ignition part without informing owners. For more, Click Here.)

Also, if you drive to work each day figure about $61 in total vehicle expenses per 100 miles. Drivers can reduce that amount by driving a more fuel-efficient vehicle or using public or alternative transportation.

(Click Here to find out when BMW will add the X7 SUV to its line-up.)

There are two other ways to save money: proper maintenance and check insurance rates. AAA, as well as other experts including the automakers, recommends reading the owner’s manual in order to figure out the right maintenance schedule. While we’re all attuned to the concept of changing the oil in a vehicle every three months or 3,000 miles, a quick scan of the owner’s manual may show a different schedule for a vehicle.

(To see what Ford is doing next to promote the new Mustang, Click Here.)

The other recommendation is to find out what it costs to insure a vehicle. There are a variety of factors that go into determining that cost and the results may be surprising.

“You’d think that a subcompact economy car would be really cheap to insure, but that’s not necessarily always the case,” Calkins told the Wall Street Journal. “Conversely, with an expensive car, say, a Mercedes, the cost may actually be fairly reasonable because the people who own those cars tend to drive them very carefully.”