Dealers for General Motors in the United States delivered 176,571 total vehicles in the month of June, down 33.6% compared with a year ago. Truck sales were down 40%, with car sales only dropping 24%. Retail sales accounted for 82% of the total, as fleet sales continue to be trimmed.

Dealers for General Motors in the United States delivered 176,571 total vehicles in the month of June, down 33.6% compared with a year ago. Truck sales were down 40%, with car sales only dropping 24%. Retail sales accounted for 82% of the total, as fleet sales continue to be trimmed.

GM’s market share, based on preliminary numbers, appears to be over 20% for the third straight month, but the brands being phased out account for roughly 4% of that. (GM’s bankruptcy plan calls for an 18.5% share of market to even reach break-even.) And its advertising spending is down 50% compared with a year ago.

However, it appears that GM’s sales decline has not leveled out yet since the overall market is off about 28%, according to numbers from AutoData Corporation. And GM declined to give a third quarter production estimate.

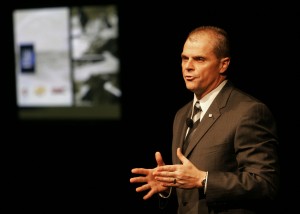

GM sales executives remained optimistic, though, at the bankrupt automaker, pointing out that GM’s June retail sales had volume up 10% percent or more than 13,000 vehicles compared to May, resulting in the fourth consecutive month-over-month retail sales increase. Camaro is clearly the hottest car in the market right now, with less than a week’s supply.

GM filed for bankruptcy on June 1, after months of negative coverage about its collapse. Year-to-date, GM sales are off almost 41%, compared with a market that is down about 35% overall.

“We’re pleased with our retail performance for the month, and it shows consumers’ strong attraction to our products – such as the Camaro, Aveo, Traverse, LaCrosse, Lucerne, CTS, DTS and STS – which all saw retail sales gains compared with May,” said Mark LaNeve, vice president, GM North America Vehicle Sales, Service and Marketing. “Customers are cautiously coming back into the market, although the industry remains very weak at approximately a 10 million SAAR (Seasonally Adjusted Annualized Rate).”

What LaNeve isn’t happy about is the SAAR, calling it “too damn low.” To counter the slump GM is offering 0% percent financing for up to 72 months available through GMAC, but GM remains out of the leasing market.

As expected GM’s four non-core brands that are being phased out saw huge sales declines compared with a year ago as Saturn declined 60% percent; Saab was down 58% percent, Hummer dropped 48% and Pontiac declined 16%.

Although GM retail sales were up in June, fleet sales of 32,725 vehicles were down 49% compared to a year ago, contributing to an overall sales decline of 89,366 vehicles versus June 2008. This drop in fleet sales was a direct result of a decision GM made to schedule down weeks at a number of its plants this summer to try and reduce growing inventories of unsold vehicles at its dealers who could no longer afford to accept more from GM’s plants. Some of the decline is also the result of fleet customers sitting on the sidelines to when it emerges from bankruptcy.

GM inventories dropped compared with a year ago, and are on track to approach the half-million mark as planned. At the end of June, about 582,000 vehicles were in stock, down about 206,000 vehicles (26%) compared with last year, and are down approximately 33% compared with January. During the second quarter GM production dropped a stunning 53% compared to year ago, as the company struggled to balance inventories in the face of ongoing sales declines. There were about 250,000 cars and 332,000 trucks (including crossovers) in inventory at the end of June. Inventories were reduced about 93,000 vehicles compared with May. This means that GM should be able to start bringing idled plants on line sometime in August.

Hybrid sales remain at minuscule levels. A total of 1,454 GM hybrid vehicles were delivered in the month. (GM offers the Chevrolet Malibu, Tahoe and Silverado, GMC Yukon and Sierra, Cadillac Escalade, Saturn Aura and Vue hybrids.) So far, in 2009, GM has delivered 8,349 hybrid vehicles; about what Toyota sells in a month.

|

GM Sales |

June 2009 |

(Calendar Year-to-Date) |

|||||

|

2009 |

2008 |

% Chg Volume |

%Chg per S/D |

2009 |

2008 |

%Chg Volume |

|

| Vehicle Total |

176,571 |

265,937 |

-33.6 |

-36.3 |

954,356 |

1,604,942 |

-40.5 |

| Car Total |

83,113 |

109,224 |

-23.9 |

-26.9 |

402,530 |

689,507 |

-41.6 |

| Light Truck Total |

91,672 |

153,105 |

-40.1 |

-42.5 |

544,988 |

899,728 |

-39.4 |

| Light Vehicle Total |

174,785 |

262,329 |

-33.4 |

-36.0 |

947,518 |

1,589,235 |

-40.4 |

| Truck Total |

93,458 |

156,713 |

-40.4 |

-42.7 |

551,826 |

915,435 |

-39.7 |

| GM Vehicle Deliveries by Marketing Division | |||||||

|

2009 |

2008 |

%Chg Volume |

%Chg per S/D |

2009 |

2008 |

%Chg Volume |

|

| Buick Total |

8,601 |

9,631 |

-10.7 |

-14.3 |

47,223 |

71,163 |

-33.6 |

| Cadillac Total |

8,473 |

14,337 |

-40.9 |

-43.3 |

48,583 |

88,709 |

-45.2 |

| Chevrolet Total |

106,712 |

159,998 |

-33.3 |

-36.0 |

596,932 |

964,665 |

-38.1 |

| GMC Total |

19,668 |

30,713 |

-36.0 |

-38.5 |

118,471 |

197,220 |

-39.9 |

| HUMMER Total |

1,078 |

2,072 |

-48.0 |

-50.1 |

6,191 |

16,158 |

-61.7 |

| Pontiac Total |

23,740 |

28,402 |

-16.4 |

-19.8 |

88,794 |

152,754 |

-41.9 |

| Saab Total |

779 |

1,872 |

-58.4 |

-60.1 |

5,386 |

12,068 |

-55.4 |

| Saturn Total |

7,520 |

18,912 |

-60.2 |

-61.8 |

42,776 |

102,205 |

-58.1 |

| GM Vehicle Total |

176,571 |

265,937 |

-33.6 |

-36.3 |

954,356 |

1,604,942 |

-40.5 |

| GM Car Deliveries by Marketing Division | |||||||

|

2009 |

2008 |

%Chg Volume |

%Chg per S/D |

2009 |

2008 |

%Chg Volume |

|

| Buick Total |

4,807 |

6,534 |

-26.4 |

-29.4 |

26,301 |

48,825 |

-46.1 |

| Cadillac Total |

6,138 |

8,568 |

-28.4 |

-31.2 |

33,043 |

58,637 |

-43.6 |

| Chevrolet Total |

46,180 |

57,868 |

-20.2 |

-23.4 |

240,979 |

387,916 |

-37.9 |

| Pontiac Total |

22,630 |

26,140 |

-13.4 |

-16.9 |

81,814 |

140,733 |

-41.9 |

| Saab Total |

602 |

1,710 |

-64.8 |

-66.2 |

3,851 |

10,152 |

-62.1 |

| Saturn Total |

2,756 |

8,404 |

-67.2 |

-68.5 |

16,542 |

43,244 |

-61.7 |

| GM Car Total |

83,113 |

109,224 |

-23.9 |

-26.9 |

402,530 |

689,507 |

-41.6 |

| GM Light Truck Deliveries by Marketing Division | |||||||

|

2009 |

2008 |

%Chg Volume |

%Chg per S/D |

2009 |

2008 |

%Chg Volume |

|

| Buick Total |

3,794 |

3,097 |

22.5 |

17.6 |

20,922 |

22,338 |

-6.3 |

| Cadillac Total |

2,335 |

5,769 |

-59.5 |

-61.1 |

15,540 |

30,072 |

-48.3 |

| Chevrolet Total |

59,631 |

100,912 |

-40.9 |

-43.3 |

352,639 |

570,624 |

-38.2 |

| GMC Total |

18,783 |

28,323 |

-33.7 |

-36.3 |

114,947 |

187,638 |

-38.7 |

| HUMMER Total |

1,078 |

2,072 |

-48.0 |

-50.1 |

6,191 |

16,158 |

-61.7 |

| Pontiac Total |

1,110 |

2,262 |

-50.9 |

-52.9 |

6,980 |

12,021 |

-41.9 |

| Saab Total |

177 |

162 |

9.3 |

4.9 |

1,535 |

1,916 |

-19.9 |

| Saturn Total |

4,764 |

10,508 |

-54.7 |

-56.5 |

26,234 |

58,961 |

-55.5 |

| Light Truck Total |

91,672 |

153,105 |

-40.1 |

-42.5 |

544,988 |

899,728 |

-39.4 |

|

GM CARS |

June 2009 |

(Calendar Year-to-Date) |

||||

| 2009 | 2008 | %Volume | 2009 | 2008 | %Volume | |

| Selling Days (S/D) | 25 | 24 | 25 | 24 | ||

| LaCrosse | 1,964 | 2,651 | -25.9 | 9,942 | 21,170 | -53.0 |

| Lucerne | 2,843 | 3,883 | -26.8 | 16,359 | 27,655 | -40.8 |

| Buick Total | 4,807 | 6,534 | -26.4 | 26,301 | 48,825 | -46.1 |

| CTS | 3,193 | 4,626 | -31.0 | 20,559 | 31,990 | -35.7 |

| DTS | 1,627 | 2,235 | -27.2 | 8,110 | 16,208 | -50.0 |

| STS | 1,220 | 1,590 | -23.3 | 3,914 | 9,711 | -59.7 |

| XLR | 98 | 117 | -16.2 | 460 | 728 | -36.8 |

| Cadillac Total | 6,138 | 8,568 | -28.4 | 33,043 | 58,637 | -43.6 |

| Aveo | 2,217 | 4,511 | -50.9 | 11,886 | 30,482 | -61.0 |

| Camaro | 9,320 | 0 | ***.* | 15,397 | 0 | ***.* |

| Cobalt | 6,847 | 20,888 | -67.2 | 51,676 | 114,250 | -54.8 |

| Corvette | 1,396 | 2,082 | -32.9 | 7,498 | 14,954 | -49.9 |

| Impala | 14,931 | 16,671 | -10.4 | 78,687 | 138,952 | -43.4 |

| Malibu | 11,466 | 13,650 | -16.0 | 75,829 | 88,575 | -14.4 |

| Monte Carlo | 3 | 56 | -94.6 | 6 | 690 | -99.1 |

| SSR | 0 | 10 | ***.* | 0 | 13 | ***.* |

| Chevrolet Total | 46,180 | 57,868 | -20.2 | 240,979 | 387,916 | -37.9 |

| G3 Wave | 515 | 0 | ***.* | 1,215 | 0 | ***.* |

| G5 | 1,671 | 2,566 | -34.9 | 4,856 | 12,491 | -61.1 |

| G6 | 9,731 | 14,620 | -33.4 | 39,622 | 85,682 | -53.8 |

| G8 | 3,622 | 1,536 | 135.8 | 15,691 | 6,270 | 150.3 |

| GTO | 0 | 33 | ***.* | 0 | 52 | ***.* |

| Grand Prix | 36 | 812 | -95.6 | 235 | 6,947 | -96.6 |

| Solstice | 939 | 1,688 | -44.4 | 2,684 | 6,881 | -61.0 |

| Vibe | 6,116 | 4,885 | 25.2 | 17,511 | 22,410 | -21.9 |

| Pontiac Total | 22,630 | 26,140 | -13.4 | 81,814 | 140,733 | -41.9 |

| 9-2X | 0 | 2 | ***.* | 0 | 3 | ***.* |

| 9-3 | 503 | 1,442 | -65.1 | 3,180 | 8,631 | -63.2 |

| 9-5 | 99 | 266 | -62.8 | 671 | 1,518 | -55.8 |

| Saab Total | 602 | 1,710 | -64.8 | 3,851 | 10,152 | -62.1 |

| Astra | 595 | 888 | -33.0 | 4,210 | 4,365 | -3.6 |

| Aura | 1,717 | 5,897 | -70.9 | 10,661 | 32,938 | -67.6 |

| ION | 9 | 38 | -76.3 | 12 | 307 | -96.1 |

| Sky | 435 | 1,581 | -72.5 | 1,659 | 5,634 | -70.6 |

| Saturn Total | 2,756 | 8,404 | -67.2 | 16,542 | 43,244 | -61.7 |

| GM Car Total | 83,113 | 109,224 | -23.9 | 402,530 | 689,507 | -41.6 |

|

GM TRUCKS |

June |

(Calendar Year-to-Date) |

||||

|

2009 |

2008 |

% Volume |

2009 |

2008 |

%Volume |

|

| Selling Days (S/D) | 25 | 24 | 25 | 24 | ||

| Enclave | 3,771 | 2,986 | 26.3 | 20,876 | 21,757 | -4.0 |

| Rainier | 1 | 9 | -88.9 | 4 | 105 | -96.2 |

| Rendezvous | 8 | 10 | -20.0 | 9 | 22 | -59.1 |

| Terraza | 14 | 92 | -84.8 | 33 | 454 | -92.7 |

| Buick Total | 3,794 | 3,097 | 22.5 | 20,922 | 22,338 | -6.3 |

| Escalade | 1,043 | 2,216 | -52.9 | 7,549 | 12,328 | -38.8 |

| Escalade ESV | 431 | 1,098 | -60.7 | 2,880 | 5,854 | -50.8 |

| Escalade EXT | 184 | 399 | -53.9 | 1,256 | 2,401 | -47.7 |

| SRX | 677 | 2,056 | -67.1 | 3,855 | 9,489 | -59.4 |

| Cadillac Total | 2,335 | 5,769 | -59.5 | 15,540 | 30,072 | -48.3 |

| Chevy C/T Series | 18 | 43 | -58.1 | 31 | 148 | -79.1 |

| Chevy W Series | 58 | 108 | -46.3 | 383 | 951 | -59.7 |

| Colorado | 2,909 | 5,842 | -50.2 | 16,908 | 32,351 | -47.7 |

| Equinox | 4,108 | 7,411 | -44.6 | 25,151 | 42,101 | -40.3 |

| Express Cutaway/G Cut | 1,264 | 1,092 | 15.8 | 5,650 | 6,714 | -15.8 |

| Express Panel/G Van | 3,196 | 3,794 | -15.8 | 14,202 | 26,810 | -47.0 |

| Express/G Sportvan | 1,298 | 2,727 | -52.4 | 6,752 | 7,751 | -12.9 |

| HHR | 6,193 | 11,126 | -44.3 | 30,724 | 50,818 | -39.5 |

| Kodiak 4/5 Series | 558 | 758 | -26.4 | 2,181 | 4,050 | -46.1 |

| Kodiak 6/7/8 Series | 267 | 309 | -13.6 | 719 | 976 | -26.3 |

| Suburban (Chevy) | 1,958 | 5,549 | -64.7 | 14,721 | 27,921 | -47.3 |

| Tahoe | 4,114 | 10,426 | -60.5 | 32,215 | 52,193 | -38.3 |

| TrailBlazer | 1,004 | 10,516 | -90.5 | 7,142 | 40,633 | -82.4 |

| Traverse | 7,289 | 0 | ***.* | 40,679 | 0 | ***.* |

| Uplander | 203 | 5,490 | -96.3 | 1,416 | 33,711 | -95.8 |

| Avalanche | 1,329 | 2,649 | -49.8 | 7,130 | 18,301 | -61.0 |

| Silverado-C/K Pickup | 24,766 | 34,290 | -27.8 | 149,949 | 231,320 | -35.2 |

| Chevrolet Fullsize Pickups | 26,095 | 36,939 | -29.4 | 157,079 | 249,621 | -37.1 |

| Chevrolet Total | 60,532 | 102,130 | -40.7 | 355,953 | 576,749 | -38.3 |

| Acadia | 4,634 | 4,197 | 10.4 | 27,360 | 38,269 | -28.5 |

| Canyon | 768 | 1,761 | -56.4 | 5,197 | 8,684 | -40.2 |

| Envoy | 714 | 2,012 | -64.5 | 3,645 | 12,959 | -71.9 |

| GMC C/T Series | 72 | 67 | 7.5 | 242 | 287 | -15.7 |

| GMC W Series | 115 | 208 | -44.7 | 778 | 1,438 | -45.9 |

| Savana Panel/G Classic | 448 | 1,137 | -60.6 | 2,791 | 5,221 | -46.5 |

| Savana Special/G Cut | 152 | 518 | -70.7 | 4,214 | 5,917 | -28.8 |

| Savana/Rally | 121 | 76 | 59.2 | 509 | 658 | -22.6 |

| Sierra | 9,014 | 12,409 | -27.4 | 50,067 | 83,174 | -39.8 |

| Terrain | 1 | 0 | ***.* | 3 | 0 | ***.* |

| Topkick 4/5 Series | 385 | 1,761 | -78.1 | 1,399 | 5,684 | -75.4 |

| Topkick 6/7/8 Series | 313 | 354 | -11.6 | 1,105 | 2,173 | -49.1 |

| Yukon | 1,832 | 3,814 | -52.0 | 14,353 | 19,855 | -27.7 |

| Yukon XL | 1,099 | 2,399 | -54.2 | 6,808 | 12,901 | -47.2 |

| GMC Total | 19,668 | 30,713 | -36.0 | 118,471 | 197,220 | -39.9 |

| HUMMER H1 | 0 | 0 | ***.* | 0 | 12 | ***.* |

| HUMMER H2 | 193 | 417 | -53.7 | 1,020 | 3,753 | -72.8 |

| HUMMER H3 | 649 | 1,655 | -60.8 | 3,845 | 12,393 | -69.0 |

| HUMMER H3T | 236 | 0 | ***.* | 1,326 | 0 | ***.* |

| HUMMER Total | 1,078 | 2,072 | -48.0 | 6,191 | 16,158 | -61.7 |

| Montana SV6 | 0 | 32 | ***.* | 0 | 64 | ***.* |

| Torrent | 1,110 | 2,230 | -50.2 | 6,980 | 11,957 | -41.6 |

| Pontiac Total | 1,110 | 2,262 | -50.9 | 6,980 | 12,021 | -41.9 |

| 9-7X | 177 | 162 | 9.3 | 1,535 | 1,916 | -19.9 |

| Saab Total | 177 | 162 | 9.3 | 1,535 | 1,916 | -19.9 |

| Outlook | 1,734 | 1,625 | 6.7 | 8,237 | 13,060 | -36.9 |

| Relay | 7 | 15 | -53.3 | 12 | 149 | -91.9 |

| VUE | 3,023 | 8,868 | -65.9 | 17,985 | 45,752 | -60.7 |

| Saturn Total | 4,764 | 10,508 | -54.7 | 26,234 | 58,961 | -55.5 |

| GM Truck Total | 93,458 | 156,713 | -40.4 | 551,826 | 915,435 | -39.7 |