Gas prices are on the rise after a lengthy free fall that has seen them drop to the lowest levels in more than five years.

The free fall in gasoline prices could be coming to an end after a seven-month drop in prices has consumers enjoying the lowest prices in more than six years.

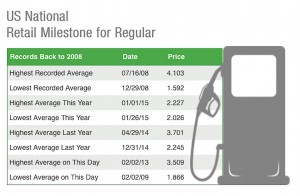

Gas Buddy, a website the tracks daily changes in gasoline prices, reported that gasoline was selling for $2.051 per gallon in the wake of the Super Bowl, which was slightly higher than the $2.026 per gallon recorded only a week ago.

AAA, however, reported last week there were indications that gasoline prices could drop again as demand as dropped in the wake of the winter storms in the Northeast. The winter weather continued over the weekend with a massive blizzard that dumped a foot of snow in a broad band stretching from Iowa into New England.

Some local increases in fuel prices, however, could be expected because of distribution problems in area socked by the nasty winter weather.

AAA reported that gasoline prices were 27 cents less per gallon than one month ago and saving $1.25 per gallon in comparison to this same date last year. However, while the declines in the national averages continue, the rate of decline has begun to slow, AAA noted.

“After dropping for an average of more than a penny a day for the first 16 days of 2015, the average drop over the past 10 days has been just half a penny. This slowing decline has been largely reflective of a number of Midwestern states where prices have moved higher over the past week due to a series of refinery issues in the region,” AAA said.

(Mileage still critical to shoppers, despite plunging prices. For more, Click Here.)

The price of crude oil hit a plateau last week after reaching a six-year lows. The price of crude climbed roughly 8% on news that oil drilling had declined sharply.

(Click Here for details about BMW’s move to block hackers.)

The rally prompted speculation that that a seven-month price collapse is at an end and the global benchmark Brent crude climbed $53 per barrel, its highest in more than three weeks in its biggest one-day gain since 2009.

(To see more about Nissan’s new Le Mans racer, Click Here.)

The late-session surge was primed by Baker Hughes data showing the number of rigs drilling for oil in the United States fell this week by 94, which is 7%. Earlier gains were fueled by reports of Islamic State militants striking at Kurdish forces southwest of the oil-rich city of Kirkuk.

Numerous U.S. shale oil producers have scaled back and are laying off people or even considering shuttering their ops with the huge drop in crude oil price. You can bet once OPEC has full control again, the prices will exceed $4/gal. sooner than later.

I am convinced there are several key reasons why the Saudis have accepted the huge price cuts of recent months, Jorge:

1) To not lose market share;

2) To pressure high-cost producers to shut down and restrict further exploration and drilling;

3) To take a swipe at key enemies, notably Iran and Russia. And if a few others, such as Venezuela, also got hurt, all the better.

The thing is, once fuel prices start rising, those alternate supply sources start to become economically justified again, so do we see a new average in the $3 range, where the fringe operators can’t make money, but there’s still a significant supply?

Paul E.

TheTIME news feed is reporting a contract dispute and strike called which could quickly stop 64% of US oil production. Just when we thought we had it good for a little while.

Paul,

I doubt $3/gal. will happen for long. I think OPEC will do the same thing again and flood the market if the fringe oil producers start up again.

Won’t be much longer before every wheat field in the Dakotas is crossed by an access road to a drill site. As infrastructure is completed, capital costs will decline, and with it the marginal production cost. Meanwhile, it will continue to cost the Saudis maybe $10 or $20 to produce a barrel. Hard to be bullish on the price of oil, at least anytime soon.