It takes more than a good deal to win over a potential customer, reveals a new study.

A happy customer, it’s been said, is a repeat customer. Yet a surprising number of automakers and their dealers seem to almost go out of their way to frustrate potential buyers, sending them scampering over to the competition.

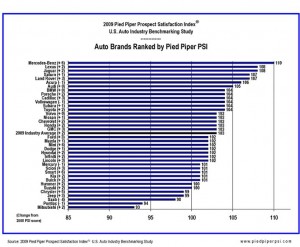

That’s a key finding of the Prospect Satisfaction Index, an annual study by the California research firm, Pied Piper. It reveals that Mercedes-Benz dealerships ranked highest in the newly released 2009 PSI, which looks at hidden facets of sales process, and how lookers are converted into serious prospects.

“Nine out of ten car shoppers walk back out a dealership’s door without buying,” said O’Hagan, who adds that, “The tough economic climate of the past year has clearly encouraged salespeople to be more helpful to the majority of shoppers who aren’t yet ready to buy, but still need help narrowing-down their selection.”

The Prospect Satisfaction Index looks at all manner of details in the way a manufacturer, through its dealers, interacts with customers at a showroom level – everything from the cleanliness of restrooms to the level of information a salesperson provides.

Not surprisingly, perhaps, the findings indicate luxury brands come off the best, with Mercedes in first place, followed by Lexus and Jaguar. The exception is Saturn, which ranked fourth, ahead of the British marque, Land Rover. Saturn has long been known for a customer-friendly sales and service process, one reason General Motors found a ready buyer for the brand in Roger Penske, who will take over its operations in the months to come.

To measure the way prospects are treated, the independent study sent 3,531 hired anonymous “mystery shoppers” into auto dealerships around the country, then used the a proprietary process to compile the results into an accurate measurement of how each brand’s dealerships treat car shoppers. While some of the brands studied are Pied Piper clients, top-ranking Mercedes is not, the research firm stressed.

The 2009 study shows a tight correlation between a brand or dealership’s treatment of shoppers and their actual performance in the retail market. Eight of the top ten brands, as ranked by PSI, also gained market share from 2008 to 2009, while eight of the bottom ten brands lost market share during the same period.

There’s been a steady improvement, over the years, in automotive quality. O’Hagan reports a similar increase in performance on the retail side, notably from 2008 to 2009, with 30 of the 37 major auto brands achieving higher PSI scores.

The improvement included five “volume” brands, Toyota, Ford, Chevrolet, Honda and Nissan. Other brands recording the most improvement from 2008 to 2009 included Mercedes-Benz, Mini, Smart and Chrysler.

Among the “orphan” General Motors brands slated for sale or closure, Saturn finished well above the industry average, Volvo scored at the industry average, Hummer scored below the industry average, while Saab and Pontiac scored well below the industry average.

Auto industry salespeople were 14 percent more likely this year to ask about obstacles preventing purchase; 13 percent more likely to mention the availability of Certified Pre-Owned vehicles; 13 percent more likely to provide reasons why it would be in the shopper’s best interest to purchase now and 9 percent more likely to ask shoppers what attracted them to this particular brand.

In addition, sales personnel were 9 percent more likely to mention the availability of different financing options this year, but less likely to offer a brochure, and were less likely to make the process of special ordering an out-of-stock vehicle seem simple and easy.

As many as one-third of a brand’s car shoppers report that their salesperson suggested that they consider an alternative brand carried by the dealership or dealer group instead of the brand requested by the shopper.

Shoppers asking for vehicles from Dodge, GMC, Chrysler, Kia and Pontiac were most likely to encounter salespeople who suggested that shoppers consider a different brand instead, while salespeople from Mercedes-Benz, Audi, Volvo, Lexus and Honda dealerships were the least likely to suggest an alternative brand.

TheDetroitBureau’s Bureau Chief Paul A. Eisenstein contributed to this report.