According to conventional wisdom, last year's oil price run-up permanently transformed the U.S. auto market. But after a brief run-up, sales of hybrids and subcompacts have come crashing down, while SUVs and pickups have regained much of their lost ground.

To listen to the media pundits, in recent months, one might come away with the conclusion that had Detroit’s Big Three only been building small cars and abandoned their big pickups and SUVs they’d be in great shape today. Last year’s oil shock, according to conventional wisdom, had resulted in a massive and permanent shift in American motorists’ buying habits.

Yet again, it seems, conventional wisdom is wrong, at least according to a new study by the research and consulting firm, Experian Automotive. There’s no question that in the early months of 2008, as fuel prices soared towards $4 a gallon, small car sales were a hot commodity, while demand for big trucks fell off the cliff. But even before fuel prices unexpectedly started to fall, again, buyer choices were already beginning to shift back to more traditional patterns.

A year after American pump prices hit record levels, pickup and SUV sales are nearly back to normal levels, while small cars yet again lag near the bottom of the sales charts.

“Everyone reported on the rapid escalation of small-car demand, but the rapid descent of small car market share went somewhat unnoticed,” Jeff Anderson, head of consulting and analytics, for Experian, tells TheDetroitBureau.com. “Anyone who predicts a long-term shift in consumer car-buying sentiment based solely on last summer’s knee-jerk reaction to gas price increases could be in for a surprise.”

That’s bound to be particularly bad news for those who were hoping that the run-up in fuel prices – and the seemingly likelihood that fuel would remain costly in the years ahead – would motivate American buyers to switch to smaller, more fuel-efficient vehicles.

Initially, at least, that seemed likely. At the beginning of 2008, when gas averaged around $3 a gallon, across the country, sales of small and economy cars amounted to about 10% of the overall new vehicle market. By May, with prices approaching $4, that had soared to 17%. Yet just four months later, when gas prices had only begun to fall back, the small and economy car segments yet again accounted for just 10% of the American market, according to Experian data.

The pickup truck segment, meanwhile, suffered a sharp decline during the early months of last year’s fuel shock, retail volumes plunging from around 14% to barely 9% between January and May 2008. But even as gas tipped $4, the truck segment was staging an unanticipated recovery, and by late Summer 2008, full-size models were actually holding a bit larger share than they had at the start of the year.

(Equally surprising is their modest decline in 2009, even while fuel prices were falling.)

“There was an obvious impact,” on pickup demand, at least initially, suggests Anderson, but automakers like Ford, GM, Chevrolet and Toyota all fought back by ramping up their incentive programs, he points out. It also helped to have an assortment of new products entering the market immediately after fuel prices peaked, the 2009 Ford F-150 and Dodge Ram models.

“Consumers,” adds Anderson, “have short-term memory,” and are highly prone to return to the sort of products they prefer to drive once the initial impact of rising fuel prices can be absorbed. That’s a pattern that has, in fact, repeated itself numerous times over the decades since the first oil shocks of the 1970s. “There’s an immediate reaction,” says Anderson, “followed by an immediate return to prior purchase patterns.”

Or nearly back, it turns out. The only part of the market to show a really significant shift over the last 18 months is the midsize passenger car segment. It’s gained about four points of market share. And, again, that may simply reflect the launch of some strong new product, including several well-received domestic offerings: the redesigned Chevrolet Malibu and updated Ford Fusion. Ford’s offering has boosted its appeal with the addition of an optional, high-mileage hybrid-electric powertrain.

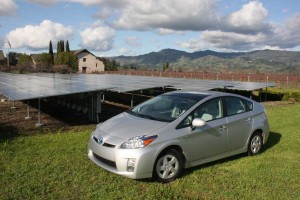

However, hybrids, on the whole, have not weathered the last year well. Sales soared in the early months of the fuel crisis, pushing the segment to a still-modest 3% of the U.S. market. By August, that was back down to 2%. The segment’s best-seller, the Toyota Prius, saw sales surge to more than 20,000 in June of 2008, but by early 2009, the Japanese maker was struggling to keep demand above 6,000 a month. Volume has picked up moderately since the recent launch of the third-generation Prius.

As for SUVs, they began 2008 at 12% of the market, slipping to just 7% by May, when gas prices reached $3.70, on average. By December, when fuel prices were back down to $2, ute sales were again at 12% of the weaker U.S. new vehicle market.

So, how can a manufacturer use such data to forecast how to plan for the future? Anderson admits that the data are so confusing, it may be impossible to predict, even if one assumes – as General Motors CEO Fritz Henderson recently forecast – that over the long-term, gasoline prices will push back into the $4 a gallon range. But with the recent increase in the federal Corporate Average Fuel Economy, or CAFE, standard, manufacturers will have to shift their plans to more fuel-efficient models, anyway.